The Bullish Pennant pattern, and how to use it

The bullish pennant is a chart pattern that is formed by an upward sloping resistance level and a converging support level. This pattern is created when the price of an asset makes a sharp move downwards and then consolidates, forming a small symmetrical triangle. The bullish pennant is a continuation pattern, which means that it is typically seen as a bullish sign and indicates that the asset’s price is likely to continue rising.

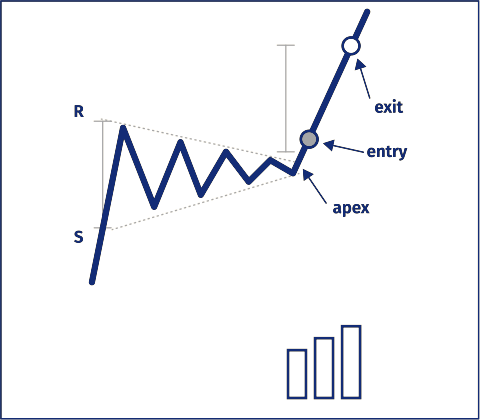

To form a bullish pennant, the asset’s price will typically make a series of higher lows and lower highs, as it consolidates within the converging support and resistance levels. The pattern is typically completed when the price breaks through the resistance level, at which point it is likely to continue rising as traders enter into long positions.

One of the key characteristics of the bullish pennant is that the trading volume tends to decrease as the pattern progresses. This is because the price is consolidating within a small range and there is less activity from traders. However, once the price does break through the resistance level, trading volume tends to increase as traders enter into long positions and push the price higher.

In order to trade the bullish pennant pattern, traders should look for the following characteristics:

- An upward sloping resistance level: This is a level at which the asset’s price has consistently struggled to break through in the past.

- A converging support level: This is a trendline that connects the series of lower highs and slopes downwards towards the resistance level.

- Decreasing trading volume: As the pattern progresses and the price consolidates within the converging support and resistance levels, trading volume should decrease.

- A breakout: Once the price breaks through the resistance level, traders should enter into long positions and expect the price to continue rising.

It is important to note that the bullish pennant is a bullish pattern, but it is not a guarantee that the asset’s price will rise. As with any trading strategy, it is important to use risk management techniques and to always be aware of the potential for losses.