October 2, 2020 1:38:59

Market Wrap – 2nd October 2020

Overnight the USD slumped with the safe havens as investors cheered positive data from the US. The US reported a decline in Initial Jobless Claims to 837K and Continuing Jobless Claims to 11.767 M. This suggests the US unemployment rate may also come in under or in line with the forecast, which is due out tonight during the US session. Additionally, Manufacturing PMI gave a boost to US equities as they came in above forecast.

Tonight’s main event will be the US Non-Farm Payrolls and Unemployment data. Another positive result may indicate the US economy is recovering from the Covid-19 pandemic faster than analysts previously forecast. However, this is where things get interesting. The US stock markets are still waiting for the next Covid-19 stimulus package. Negotiations have been on hold for a number of weeks. The House and Senate will soon take a break until after the US Presidential elections, meaning there is very little time left for them to reach an agreement on the next stimulus package. If both parties fail to agree prior to the break, it could be very detrimental to the US stock markets recent rally.

VIX Vs USDCAD

Interestingly, the VIX and the USDCAD appear to be creating a very similar setup. When there is a spike in volatility the demand for USD increases, therefore the price of the USD strengthens. When there is low volatility in the market, investors take a risk on approach meaning the demand for the safe-haven currency falls with the VIX. Currently, both the VIX and USDCAD are resting on a potential right shoulder line. If there is a spike in the VIX above the descending trend line, this may provide an opportunity to buy the USDCAD in anticipation of a move above the neckline at 1.3420.

On the other hand, if the VIX finally breaches the key support zone at 24.00 we will most likely see a breakdown on the USDCAD. This will also suggest the risk-on environment may continue, adding fuel to the recent rally in the Global stock markets. Either way, this will provide trading opportunities in the coming days and possibly tonight.

Where next for US Indices?

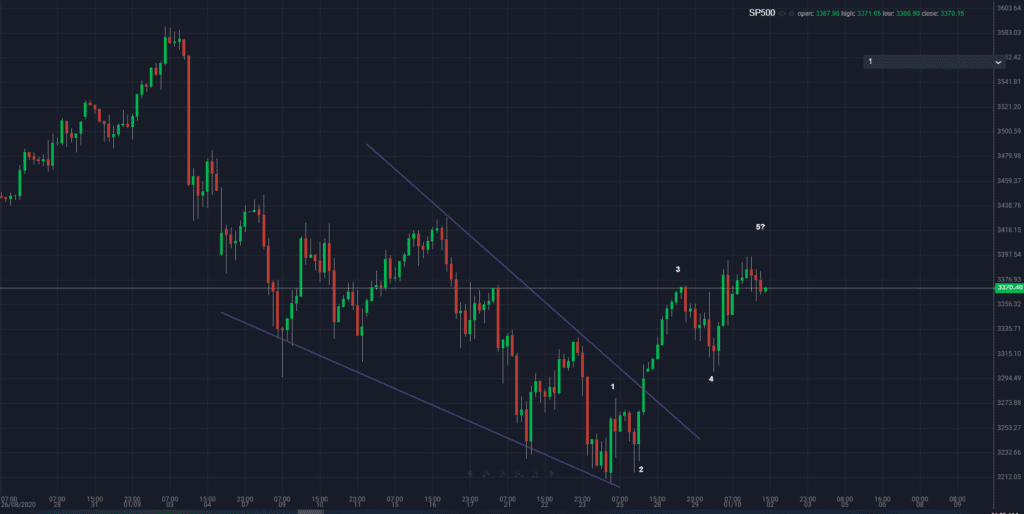

Taking a look at the SP500 we have seen a falling wedge breakout followed by a potential five wave structure higher. Generally speaking, once a five wave structure is complete, there is a larger correction lower before another move higher.

The next move on the SP500 will depend largely on the reaction of the USD and VIX during tonights US trading sessiono. The US stock market has been moving in an inverse correlation to the USD due to the USD’s safe-haven demands. Tonights Non-Farm Payroll will likely impact volatility in the market and filter through to the USD and US equities.

It will be interesting to see how this plays out.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.