November 18, 2021 10:21:03

A key driver of the loonie is the price of oil. This is under pressure today on reports that the US has asked China, India and Japan to dip into their fuel reserves. Both WTI and Brent crude have dropped below their 50-day moving averages to their lowest levels since early October. Prices are off more than 8% from last month’s three-year high.

Of course, the hawkish repricing of the Fed tightening expectations and broad-based dollar strength have bolstered USD/CAD over the last few weeks. CAD also took a hit from slightly softer inflation data released yesterday. This prompted some scaling back of rate hikes for next year.

However, the Bank of Canada is still expected to raise rates in the first half of 2022. Policymakers brought QE to an end last month and headline inflation did accelerate to 4.7%. The strong domestic economy is supported by the jobs market which is back at pre-pandemic levels. Going forward, the Canadian economy is very open so should benefit from the further recovery in global trade.

USD/CAD back above 1.26

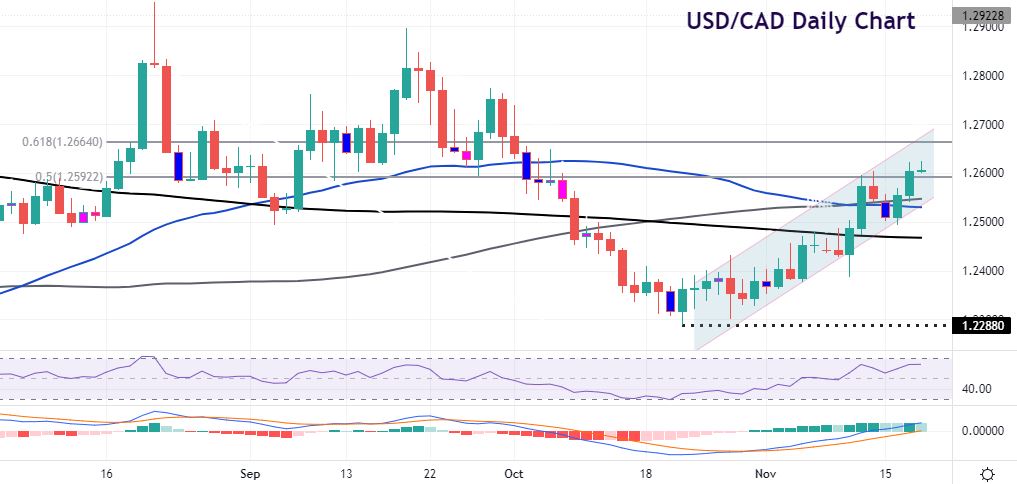

After hitting a low last month at 1.2288, the major has risen steadily in an upward price channel. Prices pushed through the 200-day SMA at 1.2474. We then consolidated around the 50-day and 100-day SMAs above 1.25.

Yesterday’s bullish move north broke above last week’s high at 1.2604. The midway point of the September/October drop sits near here at 1.2592. Trend signals have picked up again. A strong close into the end of the week will see bulls targeting 1.2664. Support lies at those SMAs with the 100-day at 1.2548.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.