October 20, 2020 6:03:35

Market Update – 20th October 2020

USD bulls have taken control during the first couple of trading sessions this week. There has been a move towards the safe havens as the window for the US Government to agree upon the next stimulus package narrows.

House Speaker Pelosi moved the stimulus negotiation deadline to Tuesday, making tonight’s US session a potential make or break scenario leading into the US elections. US Senate leader McConnell has stated the vote will take place over the next couple of days. The Republicans offer is some way short of what the Democrats are demanding, suggesting it is unlikely a deal will be reached prior to the elections.

The demand for holding USD has increased already this week as traders begin to digest the possibility of a no-deal on the stimulus front. The USD has devalued dramatically since the Covid-19 recovery due to the vast amounts of dollars being printed by the FED. If the Democrats and Republicans fail to agree upon the second stimulus package, the market could see further strength move back into the USD and downside in global equities.

The market is beginning to toy with the idea of a no-deal scenario.

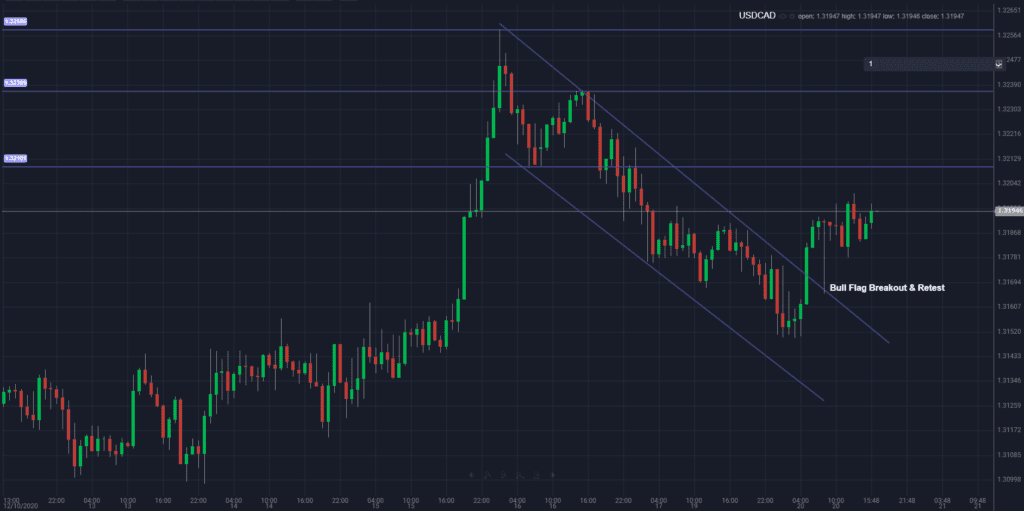

USDCAD

USDCAD 1 hour charts are showing a potential bull flag breakout followed by a retest of the broken structure. Bulls will be looking to target the swing highs at 1.3250.

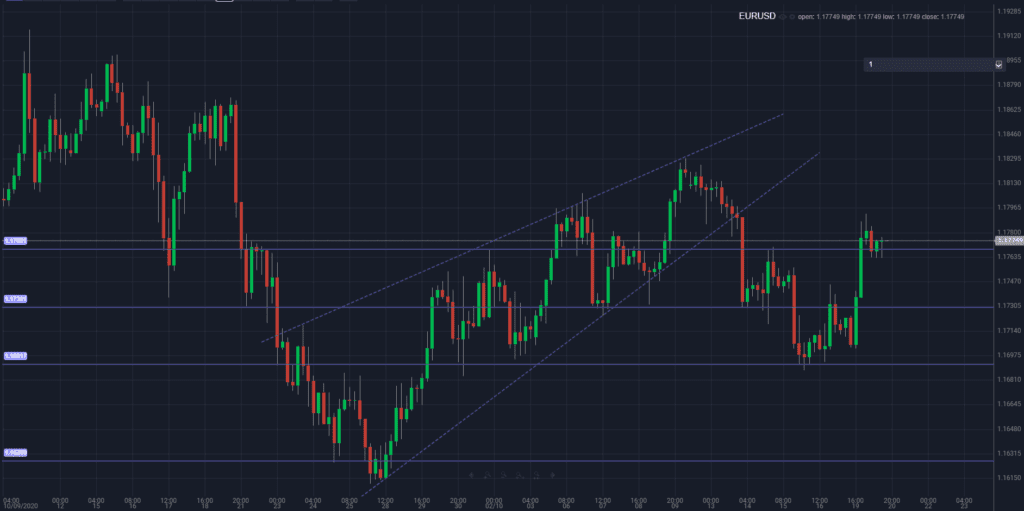

EURUSD

The EURUSD is trading on a potential right shoulder line. A break below the 1.1760 support could see the head and shoulders formation play out. The neckline can be found at 1.1690, a breach of this support zone may indicate a move towards the swing low at 1.1615.

Expect volatility to pick up over the coming days. If you have any thoughts on the stimulus negotiations please share your opinion.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.