October 21, 2020 1:00:49

Market Update – 21st October 2020

The US stock market has faced a choppy first half of the week as US Lawmakers negotiate the next stimulus package. There has been conflicting stories coming out from both sides. Nanci Pelosi, Democratic House Speaker has stated there is still time for a deal to be struck and both sides are coming closer to an agreement. Whereas McConnell, the Republican Senate Majority leader has warned the White House not to take the deal as Pelosi is operating in bad faith, attempting to complicate Trump’s Supreme Court nomination, Amy Barrett.

The self-imposed deadline is fast approaching, and the markets are craving further stimulus or threatening to sink lower. Will Nanci Pelosi come through and sign the agreement?

McConnell suggests she is stringing the Republican party along, therefore we are possibly looking for a rug pull at the last moment. If a deal fails to materialise both sides could blame each other going into the elections. From a traders perspective, an ideal scenario would be for a no-deal, the US stock market would sink lower providing a potential buy the dip opportunity coming out of the elections.

Historically the US stock market has performed well under Democratic leadership. Therefore, it potentially makes sense for the Democrats to hold off the stimulus package until they make it into power (if they do). Providing the stimulus prior to the elections could push the market towards record highs at a very early stage. Holding the stimulus package until post-election would also provide them with the ammunition they require to re-inflate the stock market.

We do know that a second stimulus package is on its way, it is just a matter of when and how large. Markets may remain range-bound until any further news presents itself.

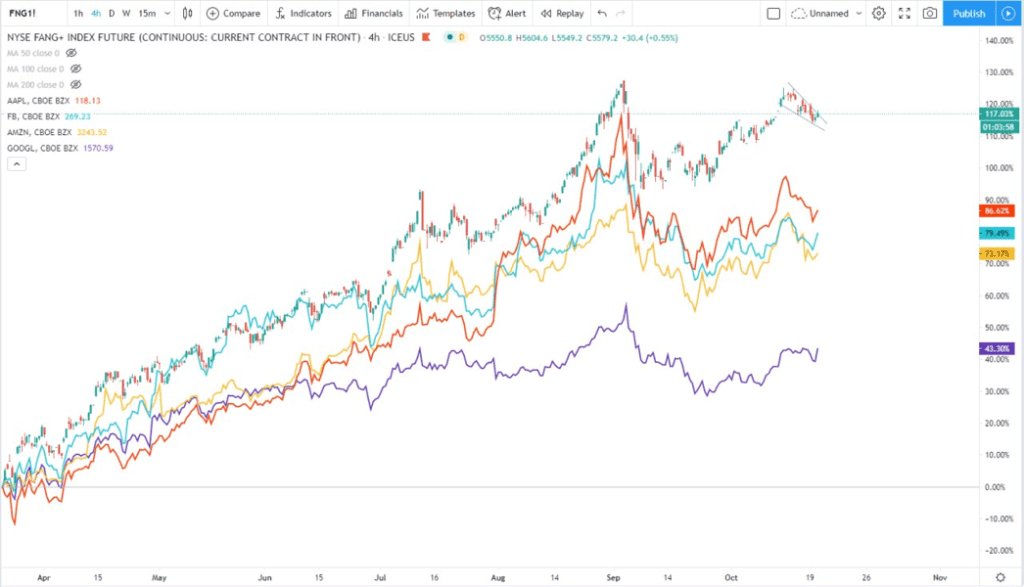

FANG Stocks

The FANG stocks, the major market movers (APPLE, AMAZON, GOOGLE and FB) are showing potential bullish structures (BULL FLAGS). A break above the bull flag could bring the rest of the US stock market higher for a final push into the elections. The FANG index is also trading between a falling wedge/bull flag. These big hitters have provided a safe haven for investors as tech stocks weathered the Covid-19 storm. Will they provide another opportunity heading into the elections?

It all hangs on a deal being reached between the two parties. This week could be a make or break scenario.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.