With 15 of the most liquid and widely traded commodity markets on offer, there are countless opportunities to capitalize on major market cycles and seasonal trading conditions.

When you trade commodities through Moneta, you gain access to markets such as Oil, Gold, Gas, Coffee, Orange Juice and more, via CFDs priced on physical assets!

Start trading commodities today!

| Platform Symbol |

Type | Market | Size/ volume |

USD value/ per tick |

E.g for tick value per tick |

1%Margin | Currency | Max. Leverage |

Min. volume |

Max. volume |

|---|---|---|---|---|---|---|---|---|---|---|

CL-OIL |

CFD Oil | Nymex/ CME |

0.01 = 10 barrels |

USD$0.10 | 99.56 → 99.57 | 1% x (10 x market price) |

USD | 333:1 | 0.01 | 20 |

NG |

CFD Natural Gas |

Nymex/ CME |

0.01 = 100 MMBtu |

USD$0.1 | 1.935 → 1.936 | 1% x (100 MMBtu x price per MMBtu) |

USD | 20:1 | 0.10 | 20 |

Gas |

CFD Gasoline |

Nymex/ CME |

0.01 = 420 Gallon |

USD$0.042 | 1.0158 → 1.0159 | 1% x (420 Gallon x price per gallon) |

USD | 20:1 | 0.01 | 20 |

HO |

CFD Heating Oil |

Nymex/ CME |

0.01 = 420 Gallon |

USD$0.042 | 1.0950 → 1.0951 | 1% x (420 Gallon x price per gallon) |

USD | 20:1 | 0.01 | 20 |

GASOIL-C |

CFD Gasoil |

Nymex/ CME |

0.1 = 10 Metric Tonnes |

USD$0.1 | 458.24 → 458.25 | 1% x (10 Metric Tonnes x price per metric tonnes) |

USD | 100:1 | 0.1 | 20 |

USOUSD |

CFD Cash |

Market Cash |

0.01=10 Barrels |

USD$0.10 | 50.00 → 50.01 | 1% x (10 x Market price) |

USD | 333:1 | 0.01 | 20 |

UKOUSD |

CFD Cash |

Market Cash |

1 | USD$0.001 | 65.731 → 65.732 | 1% x (10 x Market price) |

USD | 333:1 | 0.01 | 20 |

| Platform Symbol |

Type | Market | Size/ volume |

USD Value/ per Tick |

E.g for Tick/ Value per Tick |

1% Margin | Currency | Max. Leverage |

Min. volume |

Max. volume |

|---|---|---|---|---|---|---|---|---|---|---|

| Forex Gold |

FX Spot |

0.01 = 1 oz | USD$0.01 | 1070.60-> 1070.61 |

1% x (100 oz x price per oz) |

USD | 500:1 | 0.01 | 50 | |

| Forex Silver |

FX Spot |

0.01 = 50 oz | USD$0.50 | 12.52-> 12.53 |

1% x (50 oz x price per oz) |

USD | 100:1 | 0.01 | 20 | |

| Forex Gold |

FX Spot |

0.01 = 1 oz | USD$0.01 | 1070.60-> 1070.61 |

1% x (100 oz x price per oz) |

AUD | 500:1 | 0.01 | 50 | |

| Forex Silver |

FX Spot |

0.01 = 50 oz | USD$0.50 | 12.52-> 12.53 |

1% x (50 oz x price per oz) |

AUD | 100:1 | 0.01 | 20 | |

| Copper | Nymex/ CME |

0.01 = 250 lbs | USD$0.025 | 2.0655-> 2.0656 |

1% x (250 lbs x price per lbs) |

USD | 20:1 | 0.01 | 10 |

| Platform Symbol |

Type | Market | Size/ Volume |

USD Value/ per Tick |

E.g for Tick/ Value per Tick |

1% Margin | Currency | Max. Leverage |

Min. Volume |

Max. Volume |

|---|---|---|---|---|---|---|---|---|---|---|

Cocoa-C |

Soft Commodity |

Nymex/ CME |

0.1=1 Metric Tons |

USD$0.1 | 1928.5-> 11928.6 |

2% x (1 Tons x price per Ton) |

USD | 50:1 | 0.1 | 20 |

Coffee-C |

Soft Commodity |

Nymex/ CME |

0.1=3,750 Pounds |

USD$0.375 | 1.3340-> 1.3341 |

2% x (3,750 Pound x price per Pound) |

USD | 50:1 | 0.1 | 20 |

Cotton-C |

Soft Commodity |

Nymex/ CME |

0.1=5,000 Pounds |

USD$0.05 | 0.72152-> 0.72153 |

3% x (5,000 Pound x price per Pound) |

USD | 33:1 | 0.1 | 20 |

Orange-C |

Soft Commodity |

Nymex/ CME |

0.1=1,500 Pounds |

USD$0.15 | 1.2977-> 1.2978 |

3% x (1,500 Pound x price per Pound) |

USD | 33:1 | 0.1 | 20 |

Sugar-C |

Soft Commodity |

Nymex/ CME |

0.1=11,200 Pounds |

USD$1.12 | 0.1443-> 0.1444 |

3% x (11,200 Pound x price per Pound) |

USD | 33:1 | 0.1 | 20 |

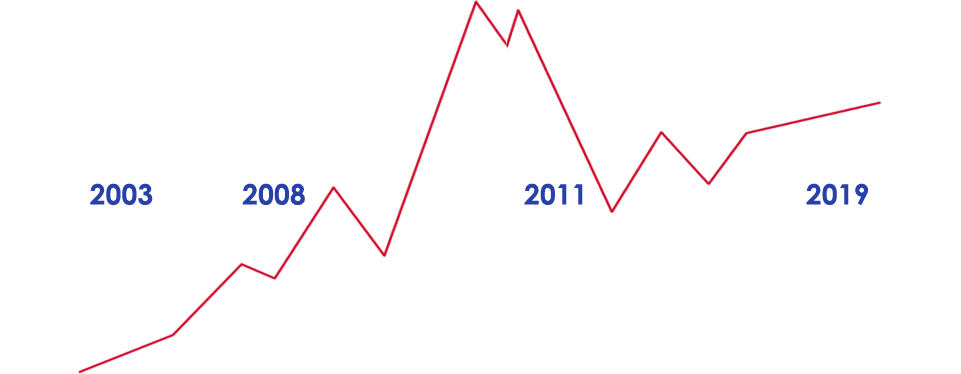

Gold breaks out of a 10+ year base and kicks off what will be a decade long monster up move.

Gold breaks out of its 6-year consolidation and possibly commences what could be the next leg of a monster move.

The US announced a bailout plan off the back of GFC signally gold's first significant pullback.

Gold is a safe haven in uncertain market conditions. Big bailouts and rate cuts signaled the end of the pullback.

Global economic prospects have improved and as money flows out of gold, it fails to make a new higher high.

Gold breaks out of a 10+ year base and kicks off what will be a decade long monster up move.

Gold breaks out of its 6-year consolidation and possibly commences what could be the next leg of a monster move.

The US announced a bailout plan off the back of GFC signally gold's first significant pullback.

Gold is a safe haven in uncertain market conditions. Big bailouts and rate cuts signaled the end of the pullback.

Global economic prospects have improved and as money flows out of gold, it fails to make a new higher high.

There's economic uncertainty. Is this the next gold rush?

trade nowOpen a live account and start trading in just minutes.

Fund your account using a wide range of funding methods

Access 1000+ instruments across all asset classes

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, the United States, any other restricted jurisdictions (e.g. blacklisted FATF countries) or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets Ltd, authorised and regulated by the Financial Services Authority of Seychelles with License No. SD144. Moneta Markets Ltd is registered and located at Room B11, 1st Floor, Providence Complex, Providence, Mahe, Seychelles which operates under www.monetamarkets.sc.

You should consider whether you’re part of our target market by reviewing our , and read our other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.