April 27, 2021 14:21:45

The FOMC meeting tomorrow looms over the market as trends are mixed and there is little to drive FX sentiment in the very near term. The small bid seen in the dollar this week may be due to some investors perhaps anticipating a more hawkish stance from Chair Powell which means some hint of tapering bond purchases. But the consensus expects a patient Fed, one that sticks to a dovish script and reaffirms no change in stance until “substantial further progress” has been made on the recovery.

This scenario should see a softer dollar in time as stimulus, vaccines and tax hikes promote a more positive risk environment and more cyclical currencies like AUD, NZD and CAD.

If the FOMC are more optimistic and welcome the more positive data and vaccination rollout, then that may be the start of the pathway to tapering and normalisation. The dollar would go bid and EUR/USD would trade sub-1.20 fairly quickly.

With Europe finally getting its act together regarding vaccine procurement and distribution, the single currency should be benefitting more from this positivity, especially as the EU fiscal stimulus plan are moving forward too.

Last week, EUR/USD paused at the 50% retrace level (from the high of the year at the start of January to the low last month) at 1.2025 but broke higher to close strongly. Three strong weeks of gains have seen a pause over the last couple of sessions at the next Fib level and the downward trendline from the early January highs. If the Fed shows its patient side, then the bulls can aim for 1.21 and beyond the trendline at 1.2160 towards 1.22. A good place for stops is around support at the 100-day moving average at 1.2056 and then that 50% Fib level at 1.2025.

This major may move the most on any Fed decision. If the consensus is correct, then broader positioning and technicals will come into play, while an unexpected move by the FOMC should see high volatility in USD/JPY. This is because there is a very strong correlation between this pair and US government interest rates and these yields are likely to react strongly to any out-of-consensus action.

Prices have been oscillating around the 50-day moving average and a prominent Fib level (38.2% from this year’s low and high). Bulls need to get to last week’s high at 108.83 to steady the ship before potentially making a move on 110. Much depends on the Fed of course, but if bond yields continue to stabilise, prices can resume their downtrend towards last week’s low at 107.47 and then 106.77. Stops can be placed at the 20-day SMA at 108.63.

Last week’s Bank of Canada meeting surprised many, not with the tapering of their QE, but by effectively saying they were prepared to hike rates within the next 18 months. This has thrown a spanner in the works for the Fed whose current stance is not to hike until 2024. With Thursday’s Q1 GDP likely to be very strong and this quarter potentially printing double figures, will Chair Powell buckle?

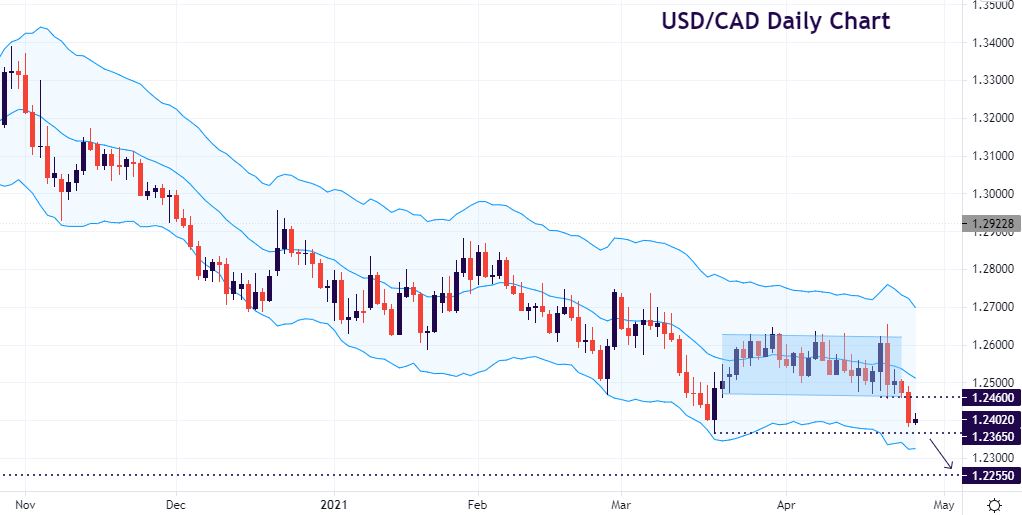

Rising commodities has boosted CAD this week and seen USD/CAD finally break lower. We like positioning for more USD losses below 1.2390 and into the cycle lows at 1.2365 and longer-term lows at 1.2231. Strong resistance stands around the break level at 1.2460 where stops can be placed.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.