April 28, 2021 14:01:27

JPY crosses have the propensity to move on either a consensus FOMC decision and outlook or one where Chair Powell is more hawkish than the markets thinks. The following pairs obviously follow USD/JPY so when key levels like 109 are near, broken or rejected in this major, the crosses will react similarly.

This cross is highly correlated with oil as Canada holds extensive oil reserves and so benefits from rising oil prices, while on the flip side, Japan imports nearly all of its crude.

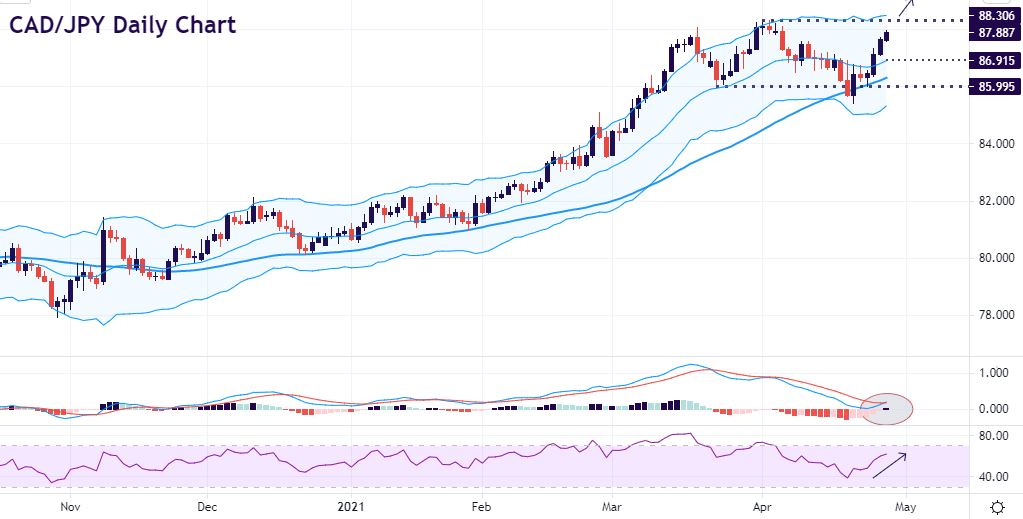

Prices were supported by the 50-day moving average last week with the weekly pin bar highlighting a rejection of lower prices. 86 is now strong support and we’ve had four straight days of gains to push CAD/JPY close to recent cycle highs. Momentum indicators are only now picking up pace so 88.31 is the next target, after which bulls will look to the October 2018 high at 89.21 which matches the 200-month moving average. With a rejection of the cycle highs or further consolidation possible, then place stops just below the 20-day moving average under 87.

AUD/JPY is the ultimate risk on/risk off currency pair and the aussie has been buffeted by a weak inflation print this morning which puts the RBA into prolonged patient mode, in contrast to the other commodity dollar currencies like CAD and NZD.

The pair has traded in a roughly 300-point range since mid-February with prices held up by the 50-day moving average. The weekly chart shows the current consolidation best with tight ranges and prices compressing just below 85. The long-term bullish trend is strong and the RSI has eased from overbought conditions with this period of sideways trading. If we get a breakout, it should be fast and in line with long-term trend. Bulls can target late 2017 and early 2018 highs above 88. Place stops below the current range lows.

This pair has the highest volume of the JPY crosses and has been pressuring the ceiling of the recent 6-week consolidation range, similar to the other JPY crosses. Yesterday saw a break higher and the strong close above 130.65 should see more gains in quick time towards 132.50 and above which are the levels last seen in the Autumn of 2018. Minor support is seen at last week’s low at 129.58 where you can place stops, with major trendline support at 129.75 which is drawn from the May 2020 low. Multiple timeframe momentum indicators (DMIs) are all aligned bullishly so any consolidation after breaking to these new highs should be brief.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.