October 6, 2021 14:30:13

EUR/USD sinks to new multi-month lows and oversold territory

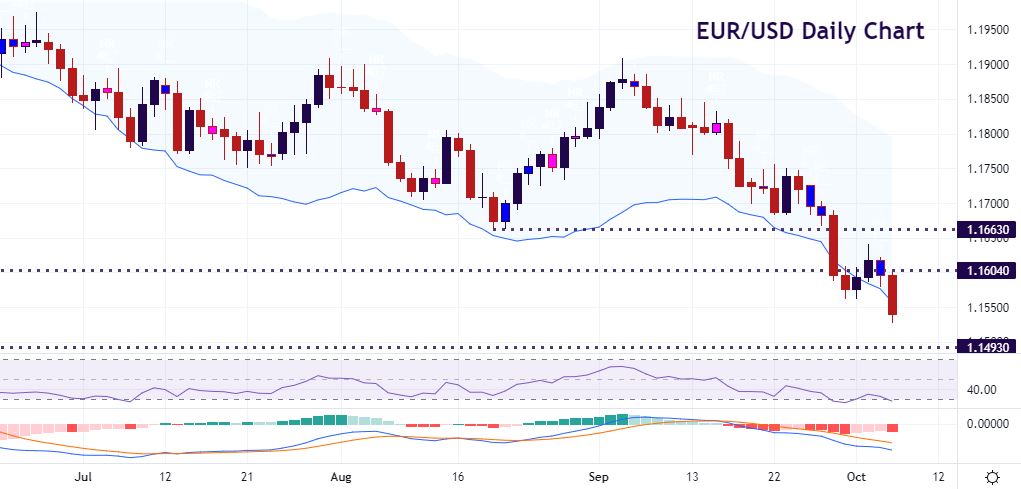

The world’s most popular currency pair made a new 2021 low today and hit its lowest level since July last year at 1.1529. Having consolidated around 1.17 recently, the last two weeks have seen bearish momentum pick up. The August cycle low at 1.1663 was initially taken out with a new trough below 1.16 at 1.1562.

Prices corrected the oversold conditions around 1.16 and the late Autumn 2020 lows. But buyers failed to get above the August bottom and have rolled over again. The next major target is the 50% midpoint of the March 2020 to January 2021 bullish run at 1.1493. But we are once again oversold on the daily RSI and through the lower Keltner channel. First resistance to a rebound higher will be the recent lows at 1.1562 ahead of the low 1.16s area.

EUR/GBP back in the range

This pair is somewhat frustrating for trend followers on daily chart, which means shorter timeframe traders may be able to capitalise. Otherwise, range trading it is with the 200-day SMA capping the recent upside breakout.

After making a swing high at 0.8658 last week, sellers came out in force and are enjoying their fifth straight day of gains. Prices moved back under the 50-day and 100- day SMAs above and below 0.8550. Today threatened a move below the spike September low at 0.8500, but this is holding firm so far. The target for bears if we close lower on the week is 0.8450.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.