April 29, 2021 14:35:08

Eurozone economic confidence soared earlier today rising to its highest since September 2018. Thanks to the improved vaccine rollout, there was strength across the board and significantly, the services sector is now also in expansion mode. This leads us to the first look at the region’s first quarter GDP figures released tomorrow at 9am GMT. Expectations are for a contraction which would technically signal a second recession in a year but remember that this data is backward-looking and old news.

We also get April inflation which is set to jump from 1.3% y/y to 1.6% due to base effects (that is comparing the figures to the exceptionally low year-on-year comparisons at the height of the pandemic). This is the more important figure to focus on as it could help the hawks on the ECB push for a faster tapering of the emergency bond buying program at their next meeting in June. This would potentially boost the euro.

We wrote last time about a patient Fed supporting the bull’s case to 1.21 and beyond. EUR/USD has done that and pushed above the descending trendline from the January high. The 100-day moving average at 1.2056 offers good support and a decent place to position stops just below, while the rising trendline support from the April lows is still in play. Target 1.22 where the next Fib level of the January to March drop lies (1.2197) and then potentially the February high at 1.2243. We note that bullish momentum studies are starting to wane and prices are bumping up against the upper Keltner band warning of a possible retrace at some point.

Sterling has been affected by political fallouts trumping the reopening of the ecoonmy and vaccination lead over the last week or so. Prices traded below 0.85 at the start of the month but the revival in EUR has sent EUR/GBP rebounding above 0.87 a few times in recent sessions. This level looks like a tough area to crack for more gains with the spike February high and April 2020 support in this zone. If we get strong eurozone data, then bulls will test this area. Otherwise, the Bank of England meeting next week may see some tapering of bond buying which means the bounce in the pair could be over as traders position for a rosier BoE. Bullish momentum is easing so if this is a pause in the downtrend from December, place stops above the recent cycle highs above 0.8720. Target the longer-term trend to kick in and initailly aim for 0.86 and the mid-April lows.

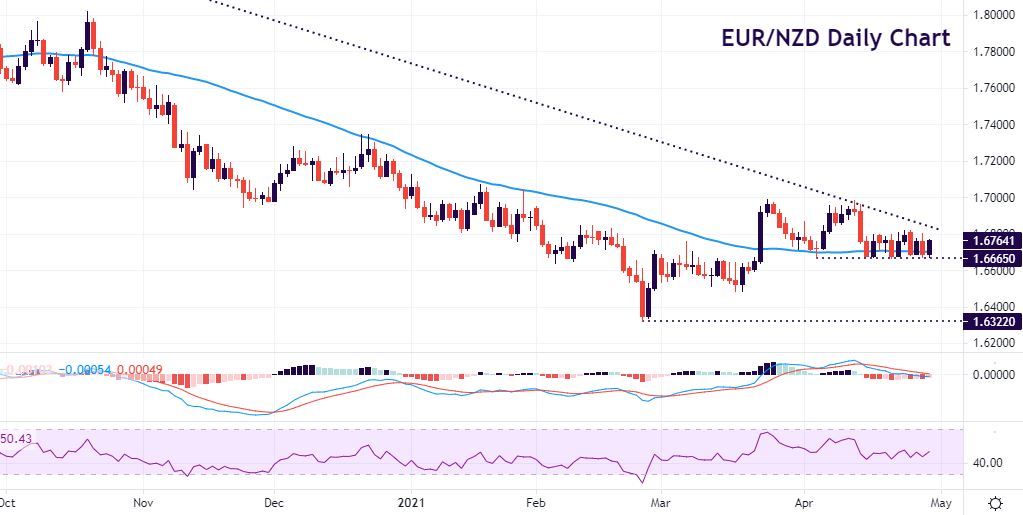

EUR/NZD might not be widely-watched but offers a compelling long-term downtrend way back from the pandemic march 2020 spike highs around 1.99. We have seen a series of lower high and lower lows from August last year until March last month and lows at 1.6322. A rebound has taken us to 1.70 but the September 2020 lows have proved strong resistance on several occasions. The pair’s downtrend is now being held up by the 50-day moving average around 1.6665 and prices have been stuck in a tight range for several sessions. Waiting for the break of this should pay off as we should target those cycle lows near 1.63 fairly quickly. Place stops above the recent range above 1.6820.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.