November 16, 2021 15:37:13

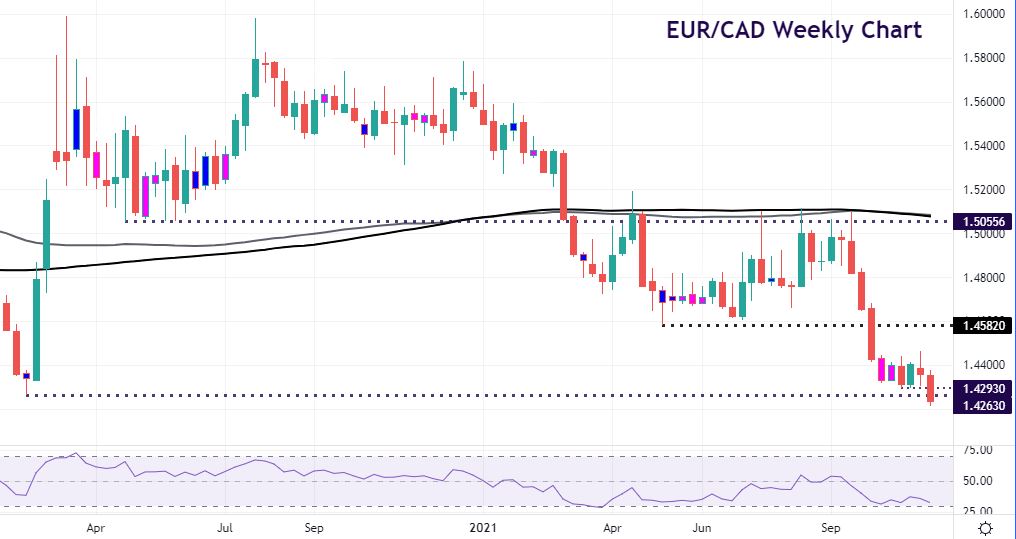

EUR/CAD weekly chart shows break of long-term support

This cross has been in a long-term downtrend since the start of the year. Prices fell to lows at 1.4582 in May. Buyers then tried pushing above the April lows around 1.5055 on a few occasions. But this resistance level and some long-term moving averages pushed prices back down to new lows at the start of last month.

A consolidation pattern formed after five straight weeks of losses. This bear flag has broken down this week with the 1.4293 low taken out yesterday. A decisive push under 1.43 implies the risk of a sharp drop with little near-term support.

Long-term levels below include 1.4181 and 1.4052. If we can hold below the February 2020 low at 1.4263, any modest euro gains should be faded. Resistance sits around 1.4442/63. The May low above looms as a stronger barrier at 1.4582.

EUR/AUD closes in on recent cycle lows

This cross topped out at 1.6436 in late August. It then fell in a tight descending bear channel from its September high above 1.62. Prices bumped along the lower Keltner band for some time, from 1.57 down to the cycle low at 1.5354 late last month.

The daily RSI was heavily oversold at this stage. The inevitable retracement took us back to as Fib level at 1.5705. But this capped a more protracted rise, along with the 200-day SMA at 1.5738.

Oversold conditions have now eased. The collapse yesterday took us through another Fib level at 1.5506 and we should see prices continue to move in line with dominant long-term trend. The February low at 1.5252 will be a bear target if we break 1.5354.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.