August 25, 2021 14:41:27

NZD/CHF now mid-range

We highlighted the crossover of the 50-day and 200-day SMA a few weeks ago which signalled lower prices were coming. NZD/CHF had just pushed through the topside of the long held descending channel, but this proved to be a false break. Prices fell sharply last week to the bottom of the trading range as the commodity risk currencies took a hammering.

The pair has now retraced back near towards the midline of the Keltner channels with the daily RSI closing in on 50. The 50-day SMA comes in above at 0.64 which has capped the upside in recent months. Near-term support is at the July low around 0.63 with the near-term bias towards a period of sideways trading.

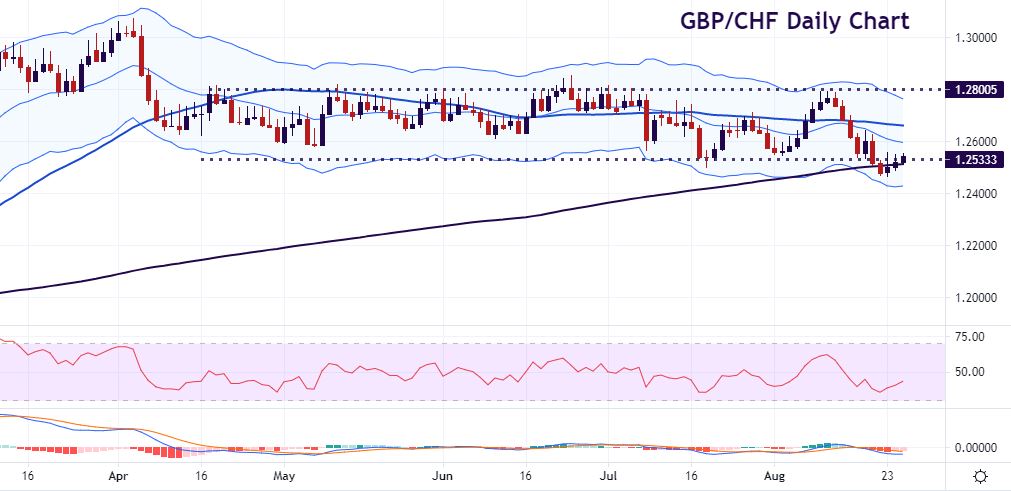

GBP/CHF clinging to 200-day SMA

This pair has been trading sideways since April between more or less 1.25 and 1.28 so playing the ranges has been the name of the game. The weekly close seemed to point to a breakdown below 1.25 and we printed a low on Monday at 1.2467. But buyers have tentatively stepped in to push the pair above 1.25 once more.

The 200-day SMA was crossed a few days ago too, the first time that has happened since December last year, but we have moved above it today. If the bulls can regain their footing, then we can trade the range with a stop below the recent bottom. On the flip side, a range breakout, after such a long period of sideways trading would see prices potentially fall quickly towards 1.24.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.