It has been a tale of two-week for the Swiss franc. USD/CHF fell about 200-pip since July 14 and looks further weakness. The currency appreciated to nearly 0.9600 against the US dollar. Global recessionary fears and a less hawkish Fed attributed to the strength of the Swiss Franc.

Further, the Swiss National Bank (SNB) is expected to raise interest rates by 50 or 75 basis points in its next monetary policy due in September. Earlier, the SNB surprised the market by unexpectedly its key policy rate by 50bps in June, its first rate hike since 2007. The central bank kept the interest rate at a record low of -0.75% since 2015. Investors remain invested in the safe-haven currency in times of uncertainty and volatility.

It seems the market already discounted Fed’s rate hike, due to be announced Wednesday following a two-day meeting.

In addition to that, the Swiss Franc crossed the parity against the EURO to trade at a seven-year high.

The US dollar index (DXY) remains depressed below 107.00, as investors geared up for the key Fed policy meeting.

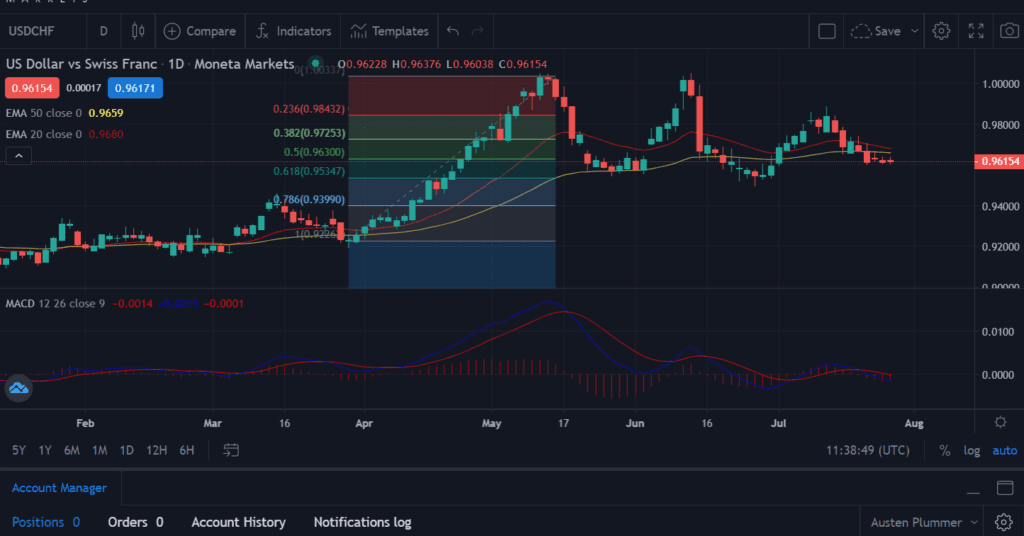

USD/CHF holds support near the 0.50% Fibbonacci retracement level

On the daily chart, the USD/CHF pair remains pressured below the 20-day and 50-day EMA’s crossover near 0.9610. This also coincides with the 0.50% Fibonacci retracement level.

A crucial level to trade, the formation of multiple Doji candlesticks suggests indecision among traders.

The moving average convergence divergence (MACD) is on the way to breaching the midline with a bearish crossover.

A daily close below 0.9600 would entice further selling opportunities in the spot. On moving lower, the price could approach the 0.61% Fibonacci retracement level at 0.9534.

On the other hand, if the buying emerges near the support zone of 0.9600-0.9610, an immediate upside target is 0.9690 followed by 0.9785.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, the United States, any other restricted jurisdictions (e.g. blacklisted FATF countries) or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets Ltd, authorised and regulated by the Financial Services Authority of Seychelles with License No. SD144. Moneta Markets Ltd is registered and located at Room B11, 1st Floor, Providence Complex, Providence, Mahe, Seychelles which operates under www.monetamarkets.sc.

You should consider whether you’re part of our target market by reviewing our , and read our other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.