September 7, 2022 14:44:44

The Pound fell to its 29-month low of 1.1400. The spot remained offered in September extending the medium-term downside trend. The price hovers near March 2020 low. A superlative U.S dollar and dovish BoE remarks—a dual factor recipe ruined investors’ taste for the Cable.

U.S dollar once again proved its status as King of the market. As the greenback continued to dominate the overall market structure including equities, currencies, commodities, and currency. The move is majorly sponsored by the rising bets that the Federal Reserve will keep aggressive mode in the policy meeting this month. A safe buying bout escalates the greenback.

The U.S dollar index holds above $110.0, a two-decade high.

Compared to U.S central bank, the Bank of England (BoE) came on the back foot. In a recent comment from the BoE policy maker. Bank’s Monetary Policy Committee (MPC) members lowered their bets for a 75bps interest rate hike at next week’s policy meeting.

Silvana Tenreyro said that the UK economy is already in a concerned state, even before the brunt of higher interest rates, as surging inflation crushes incomes.

GBP/USD continues south

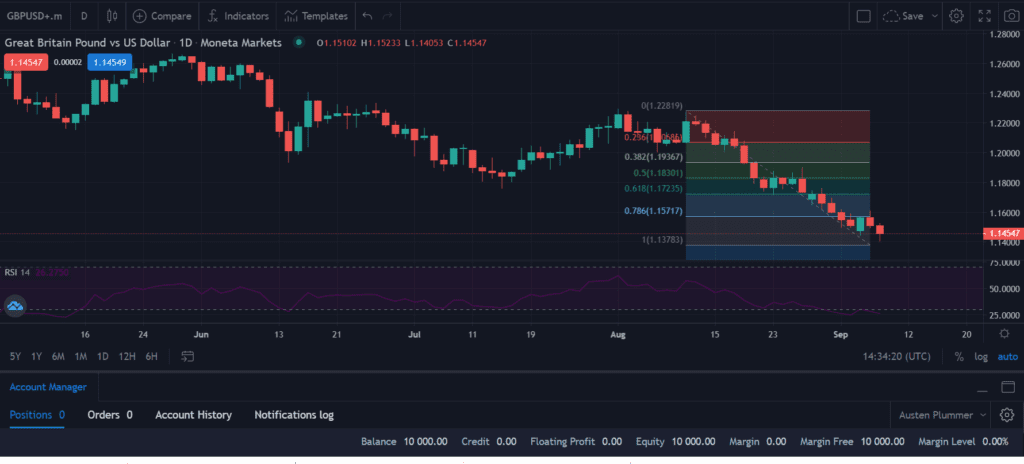

On the daily chart, the GBP/USD pair trades in a medium-term downside trend. The price tested the lows, last seen in March 2020 near 1.1400. A break below the mentioned level would bring more downside to the asset.

The RSI (14) remains oversold, which implies a bounce back is around the corner. However, in a strong market trend, the oscillator reading becomes irrelevant.

The pair begins its recent downtrend from the highs of 1.2270 made on August 10.

Amid sustained selling pressure, the price could make a new yearly lower toward 1.1200.

A move beyond 1.1500 could reverse the current course of action at least in the short term.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.