October 5, 2020 23:24:02

Equities explode higher as Trump plays down the corona-virus. As expected, President Trump is using the Corona-virus to his advantage showing the US public they can continue with their lives without fear of the virus. Trump has been quoted as saying “We have developed, under the Trump administration, some really great drugs & knowledge. I feel better than I did 20 years ago”.

The global stock market has cheered his speedy recovery as investors turned risk on this morning. This comes despite further lockdowns across parts of the EU and UK. However, the recent rally in global equities is still at risk of being undone. One question that is yet to be answered by the US Government is, will there be an additional stimulus package?

Markets are moving in anticipation of a stimulus deal. The safe havens, including the JPY and USD are again on the back foot.

“I think the market is convinced that sooner or later fiscal stimulus will materialize in the wake of data that continues to show a moderating U.S. economy,” said Joe Manimbo, senior market analyst, at Western Union Business Solutions in Washington.

The optimism was supported by White House Chief of Staff Mark Meadows, who said there is still potential for a deal among lawmakers in Washington on more economic relief, and that Trump is committed to getting the deal done.

If a deal is not reached, the USD would potentially find a short-term floor with risk assets retreating from the recent rallies.

Key Charts

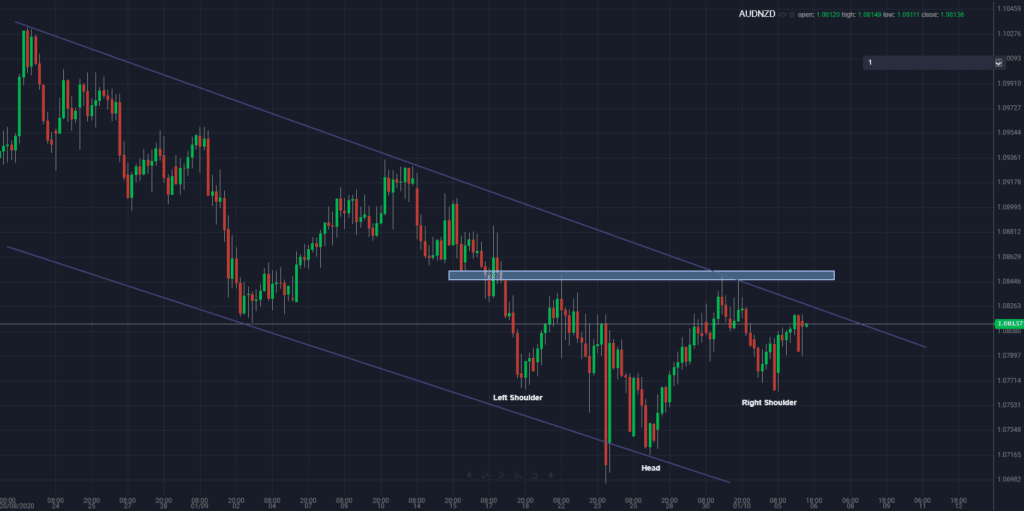

AUDNZD

The AUDNZD has been trading in a descending channel for a number of weeks. Traders are watching for a potential break higher. The 4 hourly charts are showing an inverted head and shoulder formation leading into the RBA interest rate decision and statement at 2:30pm (AEDT). The RBA has committed to keeping interest rates above the negative territory, whereas the RBNZ has suggested negative rates may be an option leading into 2021. A more positive tone from the RBA today could give the AUDNZD the fuel needed to break above the neckline at 1.0850.

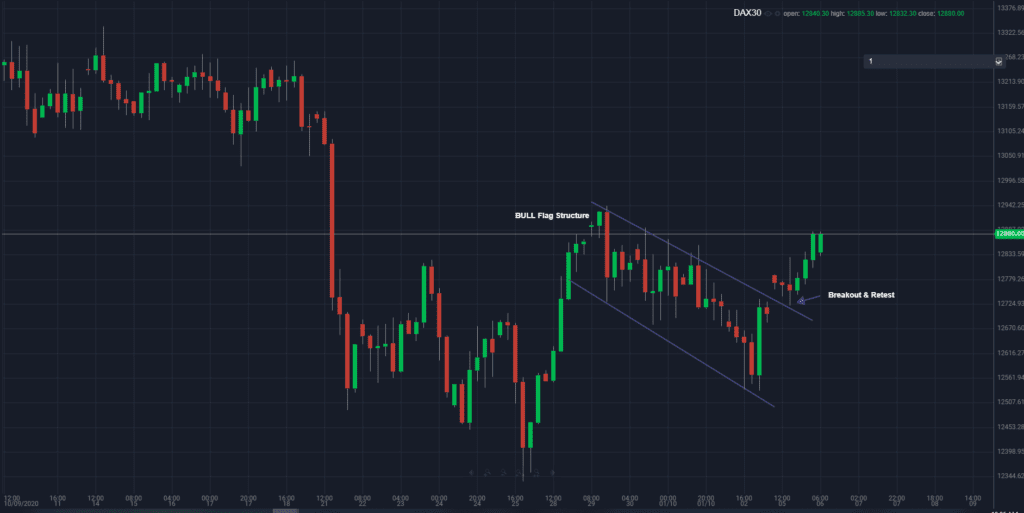

DAX (GERMAN INDEX)

Well done DAX traders, as highlighted yesterday the DAX has broken above the bull flag structure after retesting the top of the formation. The structure and market movement played out well for breakout traders. The market may continue higher if the risk in mode progresses.

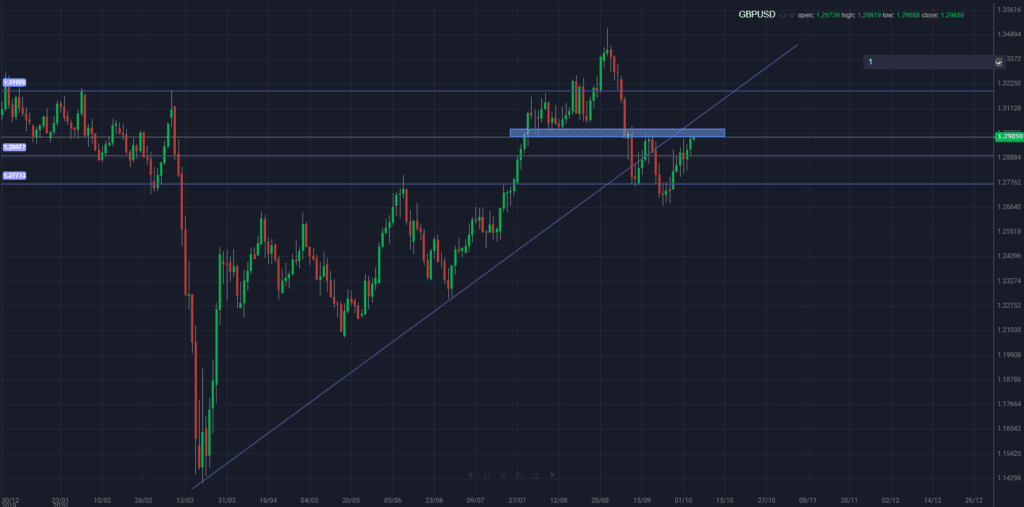

GBPUSD

The GBPUSD is approaching a key resistance zone at 1.3000. With the Brexit negotiations ongoing and reportedly progressing, the GBP may benefit from the weaker greenback. A break above resistance on positive Brexit news could see the pair return to the previous swing high at 1.3500.

If you have any questions about the topics or charts highlighted above, please reach out via email below.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.