May 3, 2021 14:03:52

Dollar holds up downtrend

The curious dollar-positive tone from Friday is failing to extend this week, capped in the USDX by the mid-march lows and the 50% retrace level of this year’s high to low move at 91.32. Prices are now trading around the 100-day SMA just above 91. It will be interesting to see whether May, which is typically a better month in seasonal terms for the dollar, holds true again after suffering an uninterrupted 3% sell-off in April so we could see some sort of short-term corrective rally. Interestingly, speculative sentiment (ie big market players like commercial traders and hedgers) have increased their bets on the dollar weakening to the highest in six weeks.

GBP/USD waiting for BoE catalyst

It was sterling’s first daily drop in six days on Friday, but today sees GBP leading the way in the major currencies and cable is again now trading above the 50-day SMA. The last three weekly lows just above 1.38 now act as strong near-term support but bulls really need to push beyond Wednesday’s high and resistance at 1.3977 to target the key 1.40 level which is acting as a solid ceiling above. Momentum indicators are neutral at the moment, but a bullish Bank of England meeting and a tapering announcement would certainly help push GBP/USD higher. However, if the MPC are more cautious, then the 100-day SMA will be a target for sellers at 1.3757.

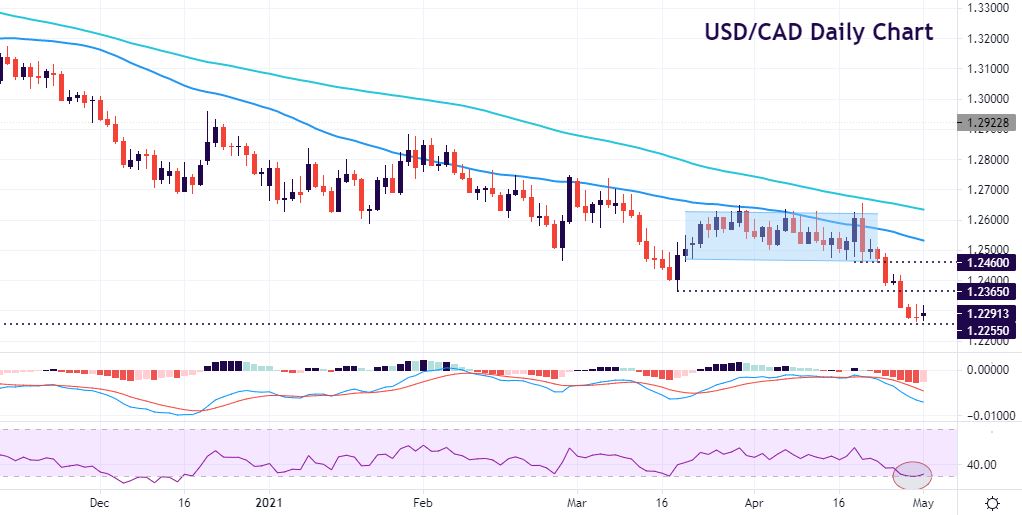

USD/CAD consolidates after break lower

After a few weeks of relatively narrow ranges, the move in USD/CAD finally came last Monday in line with the dominant long-term downtrend. When prices compress like this for an extended period, we should expect volatile, strong moves once we break. We’ve taken out the previous cycle lows through 1.2365 and are now trading sub-1.23. Prices are currently consolidating at the lows and we are oversold short-term but any minor gains are attracting better selling pressure. Next support comes at the January and February 2018 lows around 1.2250 but bears are eyeing up a full retracement of the 2017/2020 USD rally which means 1.2061. Friday’s jobs report may slow the drop if it comes in noticeably weaker, but this may present a decent selling opportunity as USD/CAD is a top pick as a central bank divergence play.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.