September 3, 2021 8:31:03

The consensus NPF headline print has drifted lower through the week and now stands at 725k. Disappointing ADP data and a contraction in the employment component of the ISM has seen analysts lower their estimates. Will the mismatch between supply and demand in the hiring process be seen in the most important monthly payrolls data?

Regarding market impact, a strong number and upward revisions are needed to shift the pro-risk mood and dollar downtrend. A middling number should find some dip buyers of the buck and a relief rally may follow. But question marks may remain as to whether this passes the Fed’s “substantial further progress” test to start tapering.

A print closer to 400k effectively means that the Fed’s condition of progress in the labour market will take longer to materialise. This will potentially delay the tapering decision into the Autumn and see the dollar drift continue.

EUR/USD uptrend comes into resistance

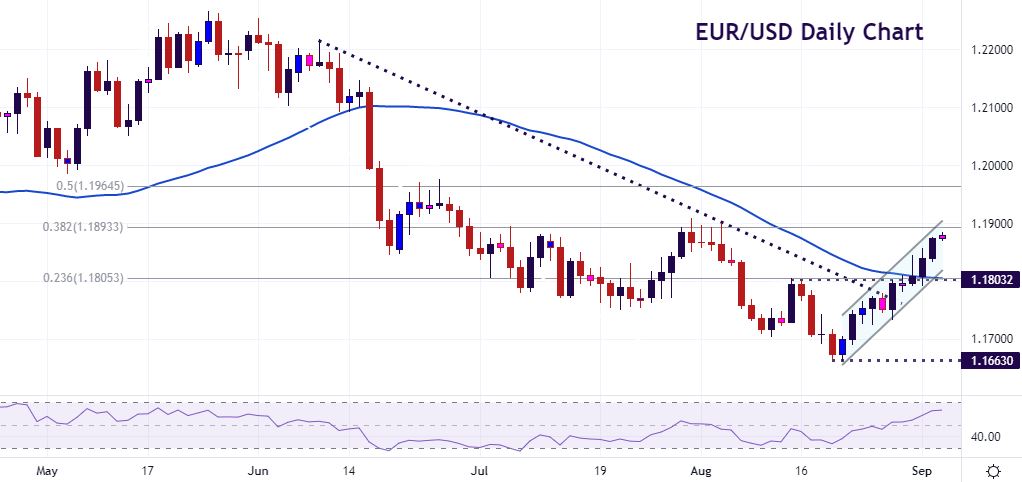

The world’s most traded pair is enjoying a late summer winning streak not seen since July last year. Prices have broken the June-August downtrend as well as near-term resistance around 1.18. The 50-day SMA at 1.1807 will now reinforce this level as the first line of near-term support.

Euro bulls are targeting the 1.1893/1.1905 resistance zone. This marks the 38.2% Fib retracement level of the June-August decline and the recent corrective high in July. The comparable level in the DXY index stands at 91.78. Prices are not overbought on momentum indicators so there is room for more upside. The 50% retracement level of the recent fall lies at 1.1964.

GBP/USD breakout stalls

Several tests of the 1.38 area in recent sessions have been rebuffed in cable. This zone contains the down trendline from the June highs and both the 50-day and 200-day SMA at 1.3805 and 1.3811 respectively. If the dollar continues to wilt, upside targets include the next big figure at 1.39 with the 50% retracement level of the June-August move at 1.3905. Otherwise, a bid in the buck will see support tested at 1.3732 and 1.3670/79.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.