October 7, 2020 4:39:33

Traders were left looking puzzled this morning as President Trump’s twitter account caused havoc in the currency market.

Trump has called for negotiators to stop any ongoing discussions with the Democratic party as their requests were unrealistic. President Trump has gone from hero to zero in a matter of days as traders previously cheered is Covid-19 recovery. US equities now look fragile along with other risk on assets.

The USD could find some strength when heading into the US session later today as traders begin to digest the series of tweets from Trump. The recent move on the EURUSD has left us questioning the next direction on the major currency pair.

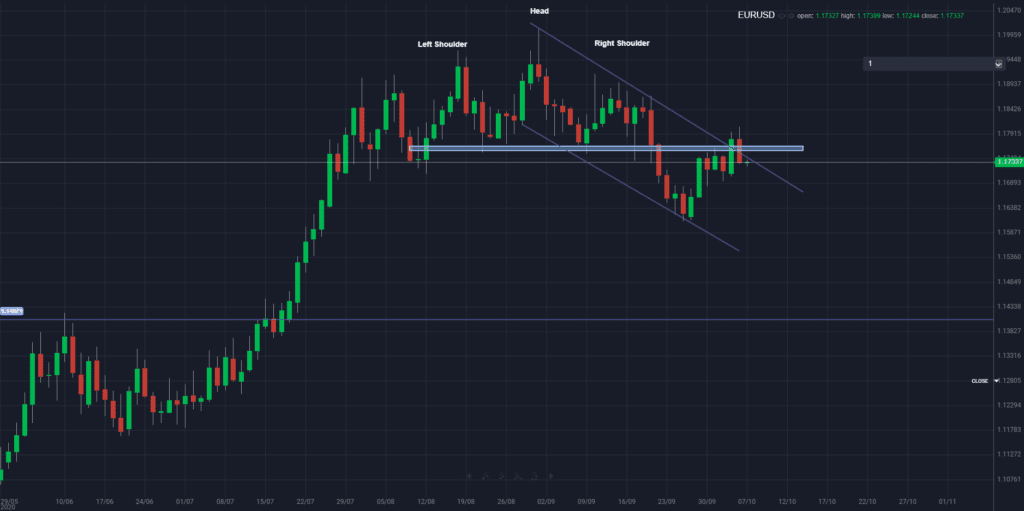

The EURUSD daily charts are showing a head and shoulders formation, which generally occurs at the peak of a trend, just prior to reversals. The market may retest the neckline as seen earlier on the EURUSD.

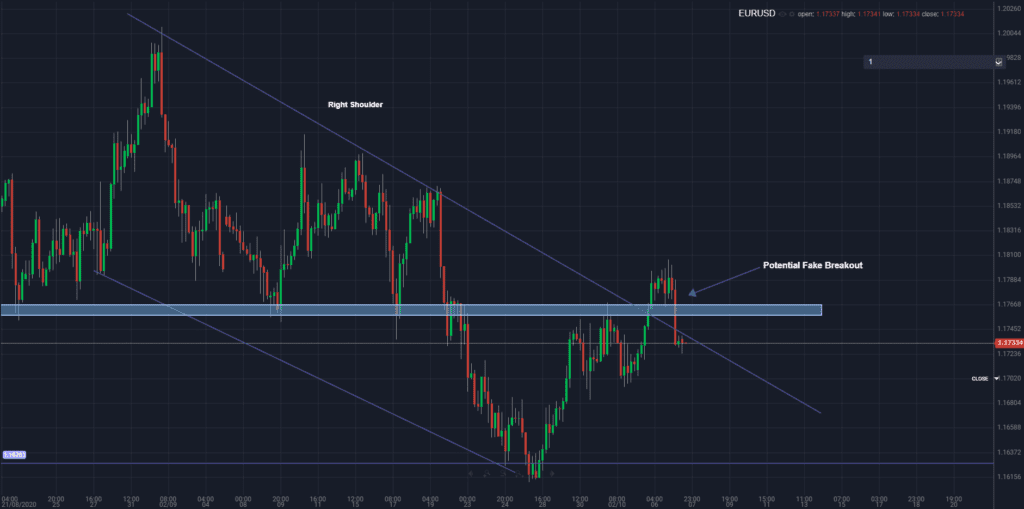

However, breakout traders were left licking their wounds as the EURUSD has erased gains made the previous day due to the recent developments surrounding the stimulus package. The EURUSD broke out of the declining channel formation as the safe haven demand of the USD decreased.

The EURUSD 4 hour charts is showing a potential fake breakout of the declining channel formation. The USD gained throughout the early trading session off the back of the negative stimulus news.

Whilst the EURUSD remains inside the declining channel, EUR bears remain in control. Major resistance can be found at 1.1760. Bears may look to target the previous swing low at 1.1630.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.