October 21, 2021 14:28:31

The Kiwi is the top performing major in October due to the buoyant risk mood and rising inflation expectations. A hawkish central bank also helps with a solid domestic recovery pushing the RBNZ into action soon. In fact, one prominent, local bank expects six more rate hikes – one at each meeting between now and August, taking the official cash rate (OCR) to 2%.

We note that NZD is the only overbought G10 currency versus the dollar so position squaring may be a risk. Slowing Chinese growth may also impact the kiwi going forward.

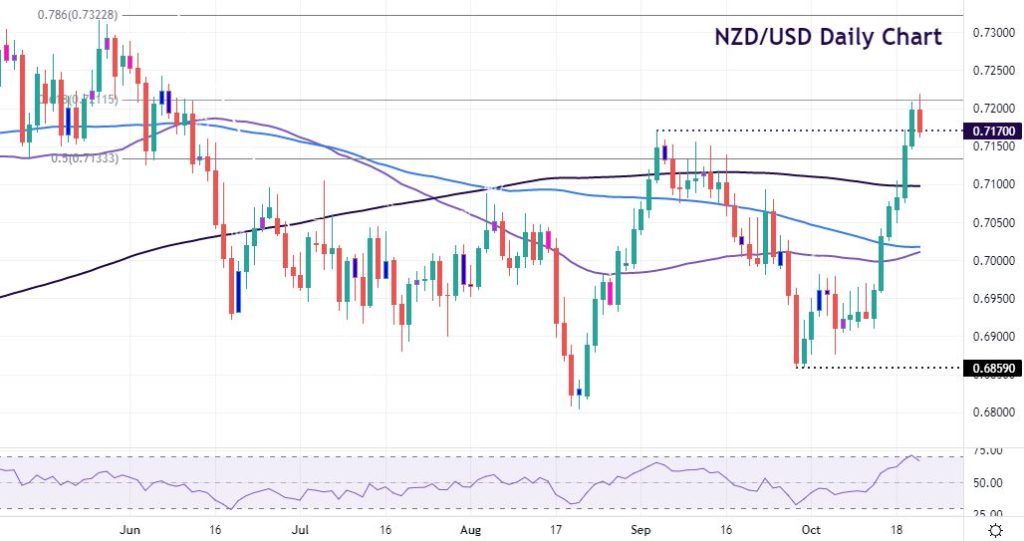

After making a cycle low at 0.6859 last month, NZD/USD has been on a tear. Long-term moving averages have been broken with the pair pushing up through the 200-day SMA at 0.71. Monday saw the midway mark of the February to August move breached at 0.7133.

Overnight, we made a new cycle high at 0.7218, having gone through the 61.8% Fib level. But prices are now in overbought territory according to momentum oscillators with the daily RSI at 70 and sellers have stepped in. The September high at 0.7170 is initial support, ahead of the 50% retrace level.

If bulls can consolidate up here with commodity prices retaining a positive outlook, upside targets are the May high at 0.7316 which sits near the 78.6% Fib level at 0.7322.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, the United States, any other restricted jurisdictions (e.g. blacklisted FATF countries) or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets Ltd, authorised and regulated by the Financial Services Authority of Seychelles with License No. SD144. Moneta Markets Ltd is registered and located at Room B11, 1st Floor, Providence Complex, Providence, Mahe, Seychelles which operates under www.monetamarkets.sc.

You should consider whether you’re part of our target market by reviewing our , and read our other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.