September 2, 2021 14:57:46

The kiwi leads the pack of major currencies this week with markets enjoying a decent bout of positive risk sentiment. Reports of a partial rollback of local virus restrictions in New Zealand have also boosted NZD. The market appears to be taking the view that any lift in local infections will not derail the RBNZ’s relatively hawkish outlook, for now at least.

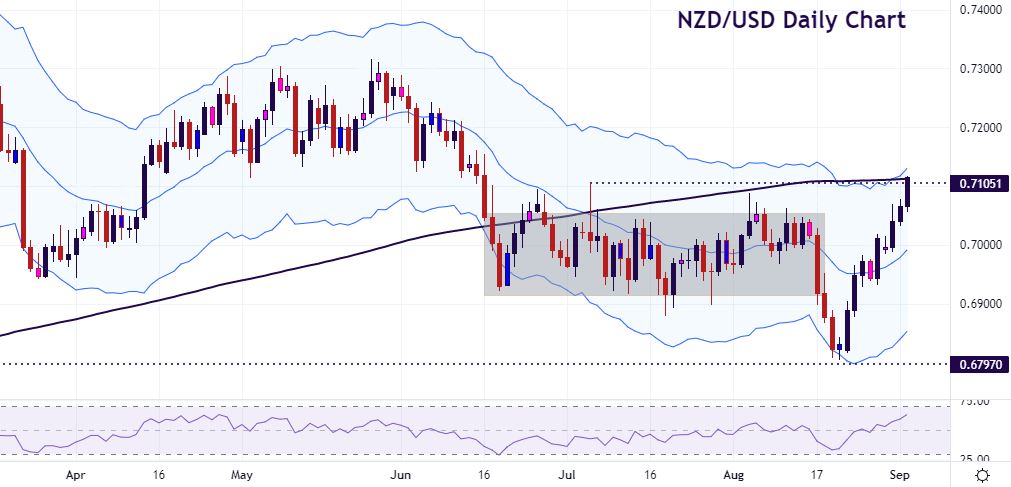

NZD/USD broke down through the lower part of the summer range in mid-August, tumbling through 0.69 to a low of 0.6805, a level not seen since November last year. Kiwi bulls got their act together when prices touched the lower Keltner band and the pair has risen eight out of the last ten days.

Prices are now challenging the widely watched 200-day SMA and the July spike high at 0.7105. The upper Keltner band sits just above here at 0.7130, which is more or less the 50% retrace level of the March to August move. The next target and Fib level comes in just above 0.72. The daily RSI still has room to move higher before signalling we are overbought. But a corrective pullback could be in order soon after such a bullish run.

We will probably need to see a headline NFP print of less than 400k for more upside in this major, as markets question when tapering by the Fed can go ahead. That said, a number above 800k could seal the deal at the September FOMC meeting. Dollar bulls should reappear with first initial support at the top of the recent range around 0.7050.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.