October 27, 2020 5:35:22

Market Update – 27th October 2020

US equities have begun the trading week off to a rocky start, however, a number of technicals are suggesting risk currencies may benefit from a weaker USD. Godman Sachs published an interesting article showing the US stock markets performance during the week leading into the elections. All but 1 out of the past 12 elections has seen a positive return on the SP500 in the week prior to the elections.

Are we setting up for another bullish move across risk assets leading into one of the years main events?

The US Presidential Elections are just over one week away and the possibility of a stimulus deal being reached is looking slimmer by the minute. Investors are growing tired of hearing about progress in the negotiations. However, with the Democrats taking poll spot to take the Senate, it is a possibility the market is anticipating a stimulus deal, if and when the Democrats come into power. It has been suggested the 2 trillion dollar stimulus package that Nanci Pelosi is pushing for will not make it through the Republican-held Senate. Therefore a Democratic Senate would increase the chances of a larger bill being passed post-elections.

A number of key charts are indicating a weaker USD may prevail this week, which suggests risk on.

Key Charts

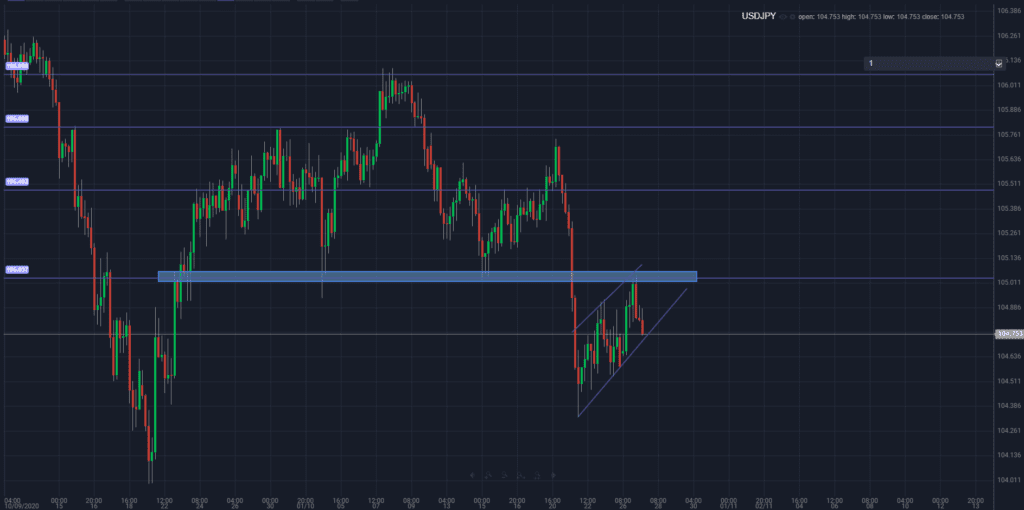

USDJPY

The USDJPY completed a head and shoulders formation, breaking below the neckline last week. The pair has retested the new resistance zone, previous neckline and it trading between a possible bear flag formation. Traders will be watching for a breakdown from the bear flag formation for a continuation to the downside.

USDCAD

The USDCAD is still capped in a negative bearish trend. If the market reverses this week’s losses, risk-on currencies will benefit and the CAD is one of them. Key support can be found at 1.3090, a breach of this zone will indicate the USDCAD may continue its bearish trend. However, a breakout of the negative trend line will suggest the risk-off sentiment may continue.

AUDUSD

The AUDUSD has enjoyed a huge run since the Covid-19 recovery. Restrictions are being lifted in Melbourne for the first time in roughly 7 months as they reported 0 new cases yesterday. There is a negative trendline resistance coming into play. A break to the upside will suggest the bull run may continue. Key support can be found at 0.7025.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.