October 12, 2020 5:03:28

Market Update – 12th October 2020

The US equity market is holding the FED/ US Government hostage, craving more and more stimulus to support the US economy. Whether the money being printed is supporting the US economy in a positive matter is an interesting question. For US citizens and USD holders, their cash is becoming worthless. Gold is currently up roughly 25%-30% as investors piled in buying protection against the oncoming inflationary pressure.

There are a number of events taking place that will likely impact the next move on gold. Today we are taking a look at the US Presidential Elections:

With the Democrats taking the lead in the US Presidential Election Polls the devaluation of the USD may continue. According to CNN, Joe Bidden is in a better position at this point in the campaigns compared to any challenger since 1936. Biden is reportedly ahead in the polls, 55% to 43% among likely voters. If the Democrats do take office, we should expect even more stimulus than what has already been provided by the US Government. With the polls at the current levels, the market is beginning to price in an even weaker USD, which may support higher gold prices.

Any sign of the US Government putting a stop to the stimulus and free money, they US stock market crumbles. Last week we all witnessed this first hand during Trump’s twitter antics.

With the market expeting another injection of cash and a potential “Blue Wave” election result, we may continue to see higher gold prices.

GOLD Technical Analysis

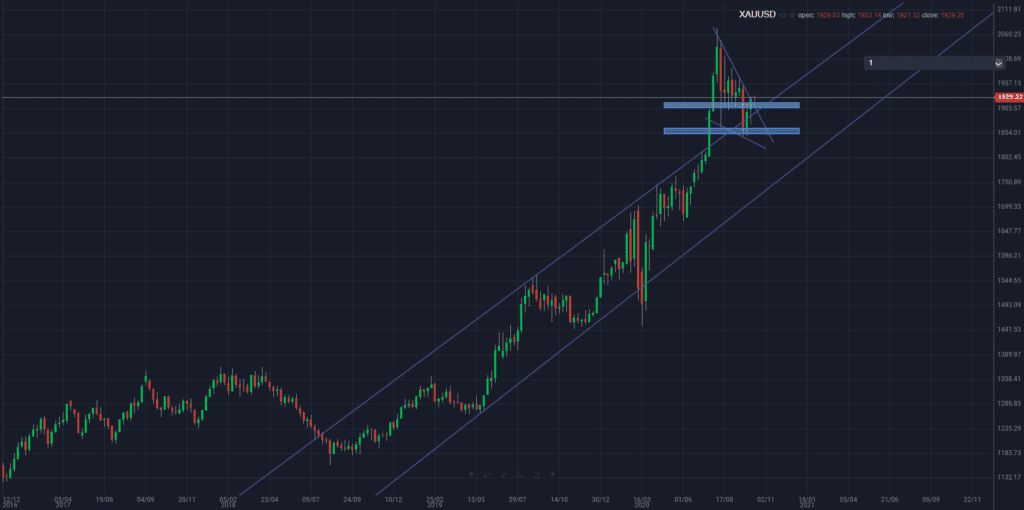

The monthly charts are showing a rejection on the previous rising channel trend line. Gold failed to close back inside the previous channel formation which would have been a bearish close.

The daily charts are showing a breakout to the upside of a negative trend line/ bull flag structure. We are seeing a series of higher highs and higher lows which is a bullish structure.

Taking a look at the shorter-term time frame we can see 1920 acting as immediate support. A break below this new support zone could indicate a retest of the broken negative trendline. Bulls will be looking to target the 1960 resistance zone, as long as the USD continues to weaken.

Let’s see how gold reacts this week. Feel free to reach out to discuss any of the topics raised above.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.