October 9, 2020 6:46:35

Market Update – 9th October 2020

The GBP has held its price against the USD despite the BREXIT deadline being only days away. Furthermore, to add fuel to the fire, the UK is expected to head back into lockdown due to the escalating Covid-19 cases.

The UK is expected to be split into three tiers of restrictions as soon as next week. Hospital admissions have accelerated over recent weeks which has put pressure on the national health service. Unfortunately, as a consequence, it is likely the death toll may surge in the near future as patients will find it harder to get the treatment they need.

Over in the US, the flip flop decision making by President Trump has caused havoc for USD traders. His U-turn on providing stimulus to the US economy has given risk on traders something to cheer about. The USD has come under pressure as a result. With US equities continuing to grind higher on hopes and speculation, it raises a question about the strength in the underlying foundations of the rally.

There are two technical structures that have caught our attention.

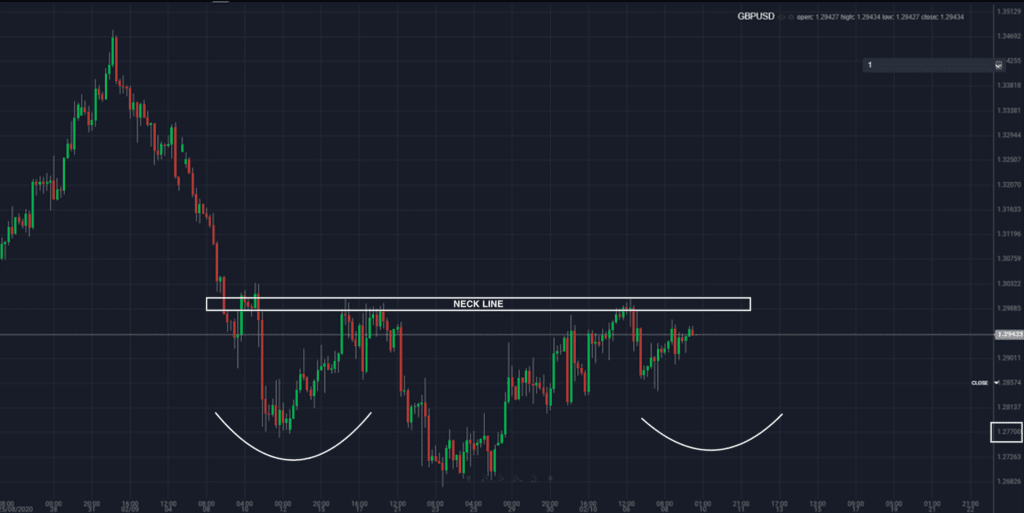

GBPUSD – Technical Analysis

On the shorter-term time frame, we can see the GBPUSD trading on a potential right shoulder line. A technical trader may also recognise the market moving into the right shoulder as a bear flag structure. The shorter-term time frame would suggest a weaker GBPUSD. A potential reason for this structure to play out could come from the UK due to the new restrictions taking place, resulting in a weaker GBP.

Moving onto the longer-term picture, the 4 hourly charts are creating an interesting structure. The GBPUSD has declined significantly throughout October due to the Brexit deadline looming. A short term move towards the 1.28 handle will raise the question of a potential rally on the GBPUSD. The 1.28 support zone will be inline with an inverted head and shoulders formation.

Of course, this is all hypothetical, we will first need to see the GBPUSD 1-hour head and shoulder formation play out, which will likely take the pair towards the 1.28 support. All eyes on the GBPUSD tonight.

If you have any questions on the analysis feel free to reach out.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.