June 23, 2021 13:58:14

Consensus expects the MPC to stand pat at the Bank of England meeting even if some are wanting the Old Lady to follow the Fed by increasing their hawkish rhetoric. Markets continue to see the first increase in rates to roughly 0.25% by the middle of next year. The majority of the bank’s policymakers are expected to stick to their view that inflation is transitory while aware that headline recent economic data has been better than the BoE forecast. With uncertainty over the Delta variant and the grand reopening pushed back to mid-July, it seems to make sense to wait for the updated economic report and projections at its meeting in August.

GBP/USD sees bulls regaining control

Cable’s third straight day of gains has seen it push past the long-term upward trendline. After last week’s tumble broke through that, the 100-day SMA and the lower Keltner channel, the pair’s daily RSI touched a rarely seen 30 level. This has resulted in a strong rebound pushing momentum indicators near the neutral 50 mark. Intraday resistance sits around 1.3990 and an advance above the psychological 1.40 level should further encourage the bulls. Indeed, a strong weekly close above 1.3964 would look like a false break of the long-term trendline. Support rests at yesterday and today’s low, the weekly lows around 1.3786/91.

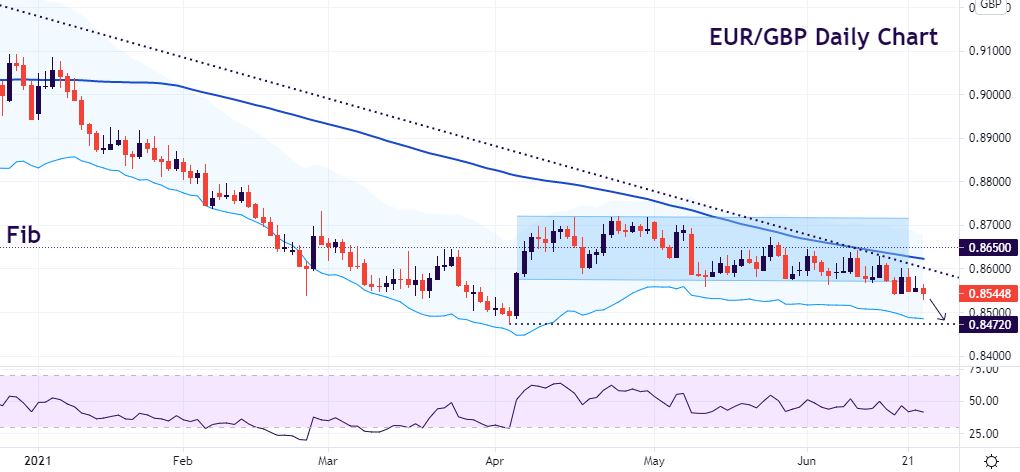

EUR/GBP drifting lower

After being trapped in a narrow range for several weeks, EUR/GBP has moved back below 0.86 due to recent higher-than-anticipated inflation and the Fed’s hawkish shift. With the BoE more advanced in policy normalisation than the ECB, the long-term downtrend should remain intact with the 100-day simple moving average acting as resistance above at 0.8625, as well as a long-term downward trendline from the December high. A Fib retracement level (23.6%) at 0.8650 lies above here which has also capped the upside more recently.

Near-term support resides at last week’s low at 0.8542 before the cycle low at 0.8472 comes into view. The direction of travel appears to be for lower prices but EU/UK Brexit tensions remain a risk with the implementation of the Northern Ireland protocol a near-term issue now the grace period is expiring.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.