July 12, 2021 14:22:27

Sterling has been the third best performing major this month, a pretty decent performance with the JPY and CHF safe haven currencies taking top honours. This has seen some GBP pairs break to new highs, as the UK gears up for “freedom day” and a potentially pivotal Bank of England meeting in August.

GBP/AUD makes new one-year highs

After making lows in December and January around the September 2020 low below 1.75, GBP/AUD has moved steadily higher this year. The pair traded up to around 1.80 into May before another advance pushed up prices above 1.84. A bullish daily pinbar candle signalled that upward momentum was picking up and a strong burst of buying saw the pair break to new 13-month highs last week. If prices can hold above previous cycle highs from October 2020 at 1.8527, the scene is set for more protracted upside. Targets for the bulls include 1.8718/28 and 1.8873. Stops could be placed below the pinbar candle low at 1.8254.

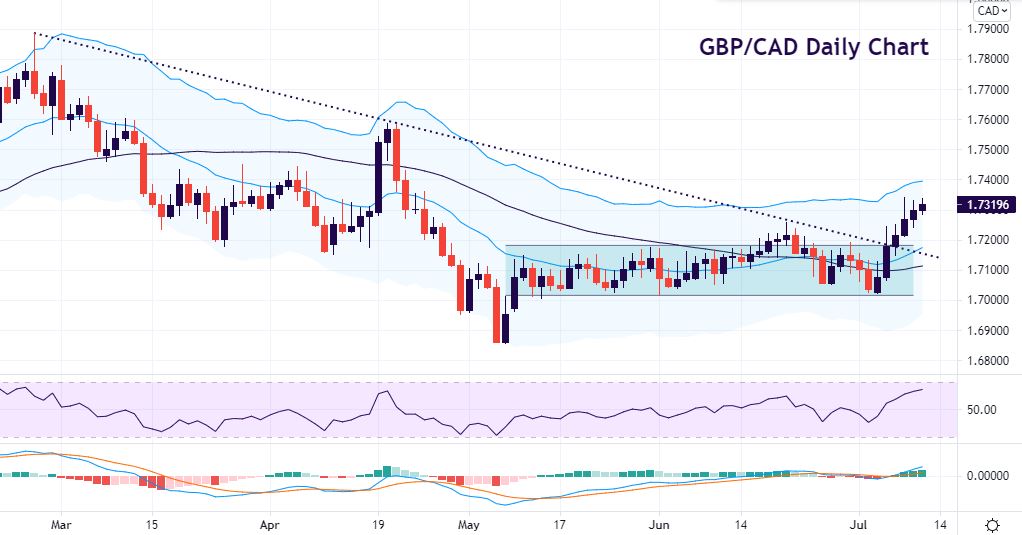

GBP/CAD breaks range and trend resistance

GBP/CAD has tracked sideways for a number of months around 1.71 but similar to GBP/AUD saw buying momentum pick up last week. Today is the sixth straight day of gains and we have broken out of the range. Significantly, the bulls have also broken through a long-term trendline from the February highs. We are not overextended yet with the upper Keltner channel coming in above around 1.74. First support comes in at the previous swing high made on 21 June at 1.7258. One key risk event to watch out for is this week’s Bank of Canada meeting with expectations of a third cut in QE and reconfirmation of rate rises coming in the second half of next year.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.