May 11, 2021 14:39:04

Sterling broke the Scottish election shackles yesterday with cable pushing to new highs and EUR/GBP moving to the lower end of its recent trading range. Political risk had been holding back GBP in recent weeks with apparent no.10 flat redecoration misdemeanours and midterm elections set to determine its near-term direction. Now, with the Conservatives in the ascendency and more significantly, the SNP’s failure to win an overall majority in last week’s election, that external (referendum) uncertainty is now off the table for some time.

Along with the lifting of the UK’s Covid-19 alert status and the reporting of zero deaths yesterday for the first time since March 2020, the UK has also seen improved forecasts from the recent Bank of England meeting with economic growth being raised to 7.25% from 5% this year.

We get GDP figures out tomorrow with consensus looking for a print of -1.7% for first quarter growth. But, remember this figure is stale and the return of schools and a heatlhier retail sector should help lift March GDP by over 2%, with substantial gains expected in the second quarter.

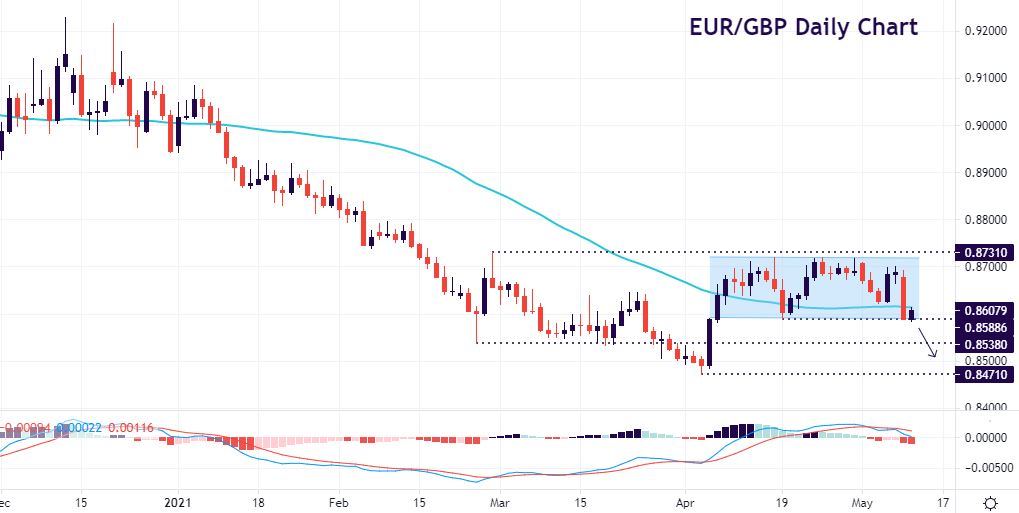

0.8589 break will push EUR/GBP to year-to-date lows

Techincally, EUR/GBP has struggled to break higher above the 0.87 zone over the last month and the pair sold off over 1.1% yesterday with the biggest down day since October. We are now trading just below the 50-day SMA and if prices close strongly below the April 19 low at 0.8588, we should certainly target the February spike low at 0.8538 ahead of this year’s trough at 0.8472. These are also the lows from March and May 2019 so may be a touch area to crack, at least intially.

GBP/JPY hits key resistance

GBP/JPY has been rising in a strong uptrend since September of last year in a series of higher highs and higher lows. The pair peaked in April at 153.41 and after some healthy textbook consolidation of severly overbought conditions, prices made a new cycle high yesterday. We are now trading at levels not seen since April 2018 so if we can hold above 153.41, the bulls could push on to the early 2018 highs between 155.50/156.50. It’s all about price action around this major high and with risk sentiment slightly precarious this week, we are wary that any correction could be sharp and see JPY rally strongly. But the long-term bullish trend is strong and more upside should be seen soon.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.