October 28, 2020 6:51:51

Market Update – 28th October 2020

US election polling – Real Clear Politics have Trump on 48 and Biden 44 in Florida, one of the key battle states. News breaking this morning has pushed US equities lower as the gap between Biden and Trump narrows. Clearly, the market does not like the possibility of a Trump victory. If the gap between Trump and Biden continues to narrow, there is a possibility of a contested election, Trump has warned he will not go willingly. The recent appointment of the Republican Supreme Court judge could be in preparation of a contested election.

The USD has gained across the board in the early Asian session with the EUR coming under pressure against the USD and JPY.

To add further pressure, across Europe, the threat of additional lockdowns has hit the Europen Indices with the DAX falling roughly 700 points since the Monday open. Germany is discussing a two-week corona-virus shutdown and the French President is considering a month-long national lockdown. We are yet to hear what measure will be involved.

It appears as though there are a number of risk events weighing on the market. Market Sentiment appears to be changing, especially with the surging Covid-19 cases across Europe. The sentiment shift plays into the USD long positions. We are also faced with the ECB interest rate decision and statement this week. Investors are growing concerned about the speed at which the €750 billion Pandemic Emergency Purchase Programme is being rolled out across Europe. However, there are murmurs of the ECB increasing the size of the program, which is potentially keeping the EURUSD above water, for the time being.

EURUSD Technical Analysis

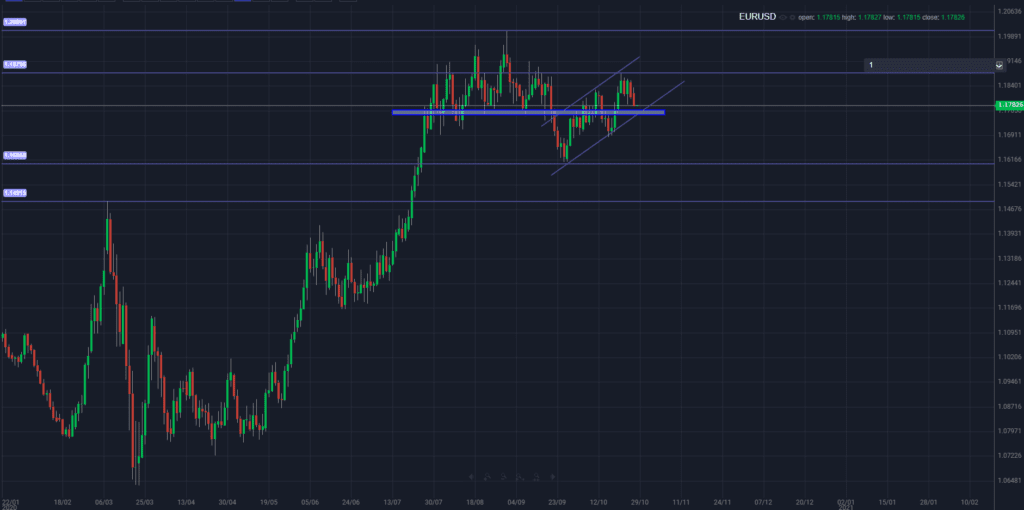

EURUSD – Daily Cahrts

The rising channel formation can be classed as a bear flag structure. We are currently questioning whether the full retracement in the EURUSD has occurred. If the ECB does not give an indication they are willing to increase the PEPP the risk-off flows may continue into the week’s end.

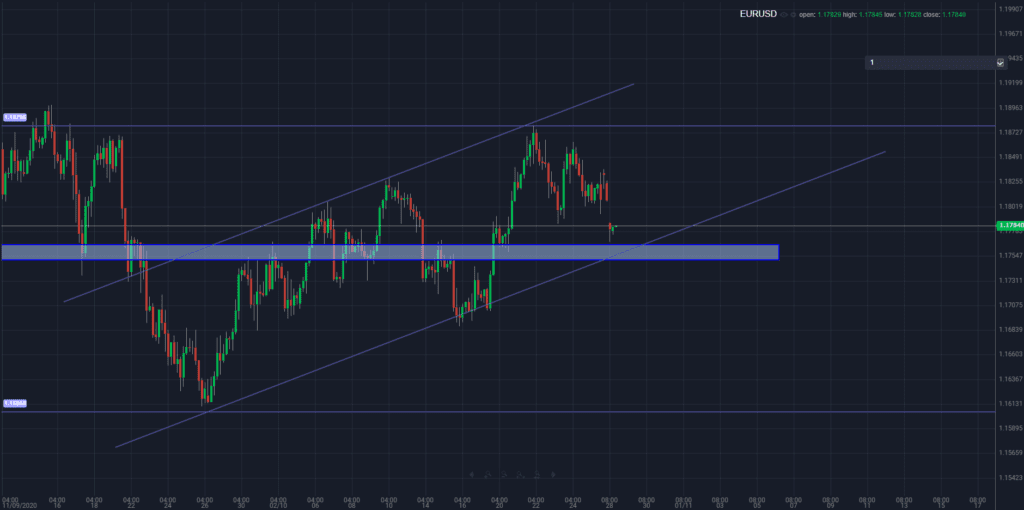

EURUSD – 1 Hour Charts

The EURUSD is approaching a crucial zone inside the rising channel formation. Depending on how the market takes the additional lockdowns this evening, there is a risk of a break lower on the pair. 1.1740 appears to be the crucial support zone.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.