October 22, 2020 5:11:18

Market Update – 22nd October 2020

The stimulus countdown clock is ticking with just under two weeks until the Presidential elections. The risk-off sentiment seen during this mornings sessions shows investors are growing tired of hearing that stimulus talks are “progressing”.

There have been conflicting stories coming out from both sides. Nanci Pelosi, Democratic House Speaker has stated there is still time for a deal to be struck and both sides are coming closer to an agreement. Whereas McConnell, the Republican Senate Majority leader has warned the White House not to take the deal as Pelosi is operating in bad faith, attempting to complicate Trump’s Supreme Court nomination, Amy Barrett.

It is widely understood that a stimulus package will arrive at some point, it is just a matter of when and how large. McConnell has made it known that the Republican party, who control the Senate, are not in favour of such a large package. The longer the negotiations continue, the less likely chance of a package being agreed upon prior to the US Presidential elections.

US equities are looking fragile and threatening further downside if a stimulus package is not provided soon. If a stimulus deal is struck, the EURUSD may provide an opportunity to continue its bullish momentum after facing a pullback.

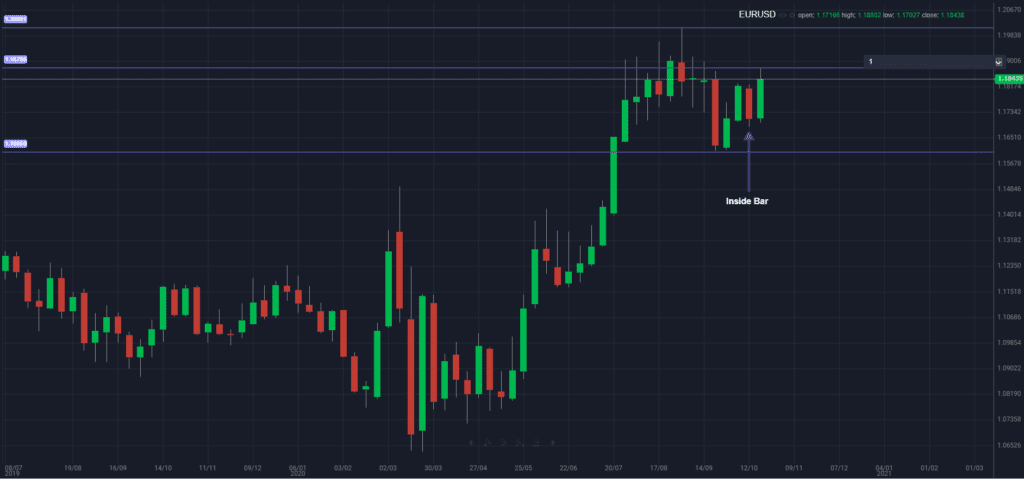

EURUSD – Weekly Charts

The EURUSD’s fate hangs in the balance with the weekly charts showing an inside bar. An inside bar can indicate reversal opportunities as well as a continuation of a trend. We will need to see confirmation during this weeks closing price. A close above the weeks previous high will indicate bulls are in control.

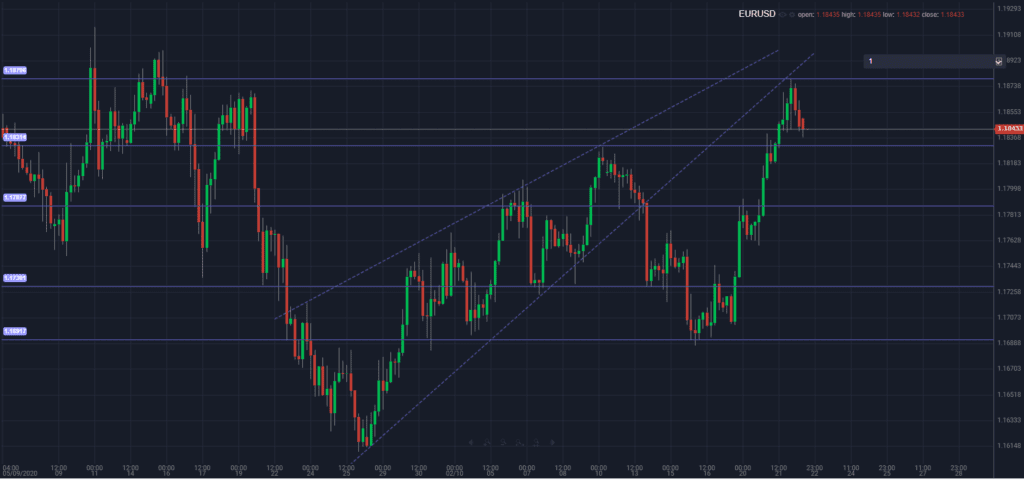

EURUSD – 1 Hour Charts

The 1-hour charts are showing a temporary resistance zone at a key trend line. The EURUSD has been rejected from the previously broken trend line at 1.1880. Bulls will need to break above resistance to convince the market of a continuation of further upside.

Immediate support can be found at 1.1835. A breach of the key support zone may indicate the market is not convinced a stimulus deal will be reached prior to the elections.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.