October 14, 2020 4:30:28

Market Breakdown – 14th October 2020

EURUSD bears are currently in control as US stimulus talks look set to breakdown and the Brexit deadline looms on Thursday. The news has remained quiet on the Brexit front this week leading into Thursdays make or break meeting. It remains a possibility that the UK could walk away from the EU without a deal in hand.

On the US front, McConnel the Senate majority leader said the first order of business is to vote on a much smaller stimulus bill worth roughly $500 billion. The US Government is set to vote on the bill during the next meeting on the 19th October. This raises the question of whether a deal will be struck prior to the US elections in November due to the firm stance from Nanci Pelosi.

Goldman Sachs strategists have suggested selling the USD on positive Biden and vaccine news. A democratic win will no doubt mean more stimulus for the US economy post-election.

However, yesterday, Johnson & Johnson reported they have placed their Covid-19 vaccine on hold due to a participant experiencing an unexplained illness. Both events overnight resulted in a stronger demand for USD. This brings us to the EURUSD charts.

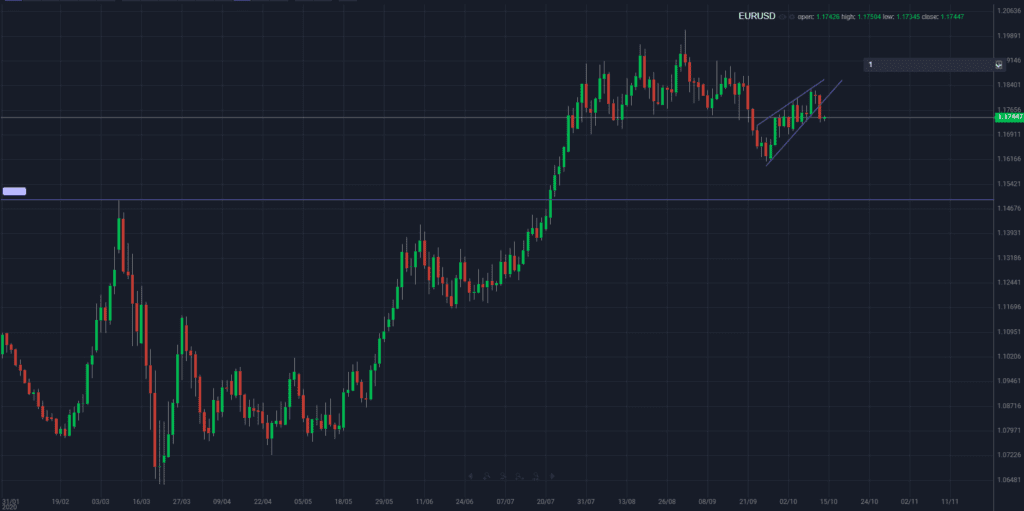

EURUSD Daily Charts

The daily charts are showing a bear flag breakdown. This falls in line with the negative news about the stimulus package, as well as the covid-19 vaccine story.

EURUSD 4 Hour Charts

Currently, the market is holding support at the 1.1730 handle. There is a possibility of a retest of the bear flag formation, which may also produce a head and shoulders structure. A rejection from the bear flag may provide an opportunity for sellers to step into the market.

Will bears remain in control? Let us know your thoughts.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.