October 16, 2020 5:56:24

Market Update – 16th October 2020

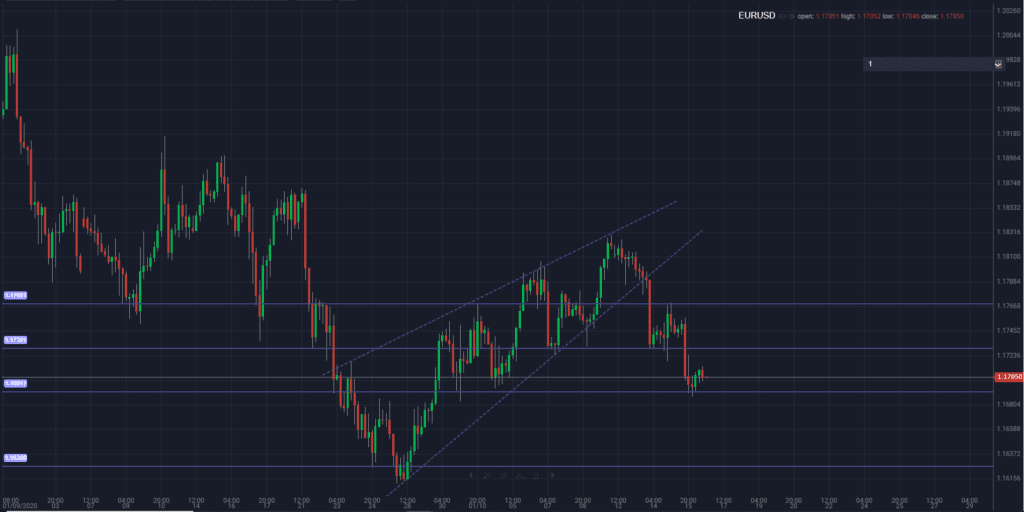

The EURUSD came under pressure breaking down from a bear flag formation. Currently, the pair is sitting on support at 1.1700. The risk-off flows seen during yesterday’s trading session was a result of an increased number of hospital admissions across the EU and the possibility of further restrictions coming back into play. The recent surge in Covid-19 cases has put a dent in the EU’s economic recovery plan.

On Thursday France reported an additional 30,000+ cases, up from 22,000 the day previous. Italy, Poland and Germany all recorded their largest daily rise in Covid-19 infections. To add even more fuel to the Covid-19 train, Johnson & Johnson paused their Covid-19 vaccine trial due to an unexplained illness in one of the patients.

Overnight traders rushed into the safe-havens as risk events continue to pile in. On the Brexit front, Boris Johnson is set to announce his decision on whether he will continue negotiating with the EU on a post-Brexit trade deal. It has been reported by the British negotiator David Frost that the EU is no longer committed to working ‘intensively’ towards an agreement. The big question is will the UK Prime Minister finally pull the pin.

What does this mean for the market?

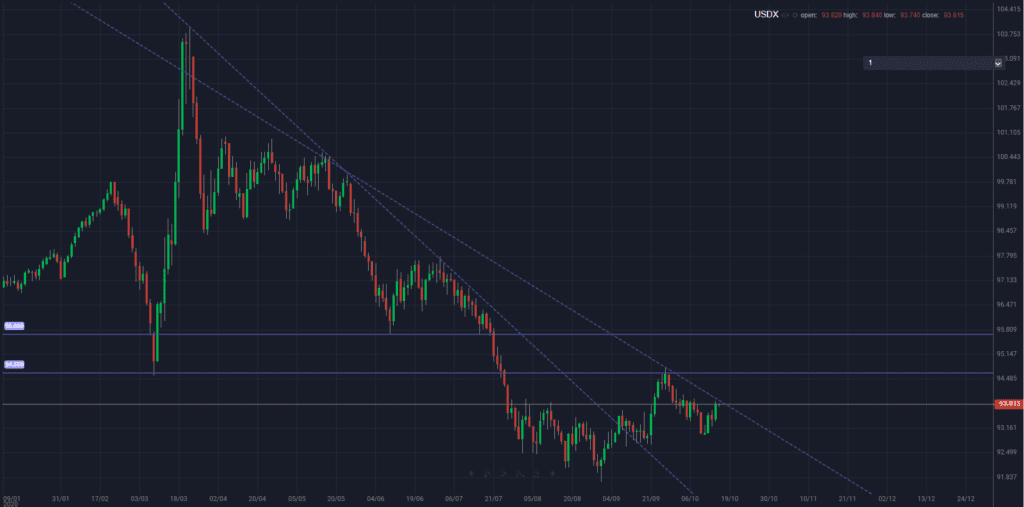

DXY (USD Index)

The US Dollar Index is currently trading at a key trend line resistance. The market is taking a breather leading into the EU session. A break above the negative trend line could indicate a more sinister drop across risk assets as traders look to purchase safety protection. A break above the negative trend line could see the index retest the 9460 region.

EURUSD

The EURUSD is holding support on the 1.1700 handle. All eyes will be on the DXY, a break above the negative trend line will no doubt push the EURUSD towards the swing lows at 1.1625.

Possible catalysts for another surge in the DXY could be an additional rise in Covid-19 cases/hospitalisations across the EU. Prime Minister Johnson pulling the pin on the Brexit deal, and any further negative press regarding the second US stimulus package.

There is also the possibility that Johnson may extend the Brexit deal, if so this may provide a small amount of relief in the market.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.