September 29, 2021 10:19:25

The euro has held up relatively well this week compared to other more high-beta currencies. But generalised risk-off has taken hold in markets resulting in a bid to the dollar. This has primarily been due to fears around higher inflation which have pushed up bond yields and so hit global stock markets. China Evergrande lurks in the background while the US debt ceiling standoff is coming to a head.

Last week’s hawkish tilt by the Fed has also been a factor bidding up the greenback. Markets have finally taken on board the shift in the dot plot. Chair Powell recently pointed to upside risks to prices posed by bottlenecks and hiring difficulties. We now know that tapering conditions have been met on the inflation side while the jobs part of the Fed’s mandate “is all but met”.

From the continent, ECB President Lagarde yesterday warned against overreacting to temporary inflationary pressures. There is also not much support from the immediate economic and political backdrop in terms of the energy crunch and German elections. We get the latest CPI data from the region later this week. Multi-year highs are expected to bring out the ECB hawks.

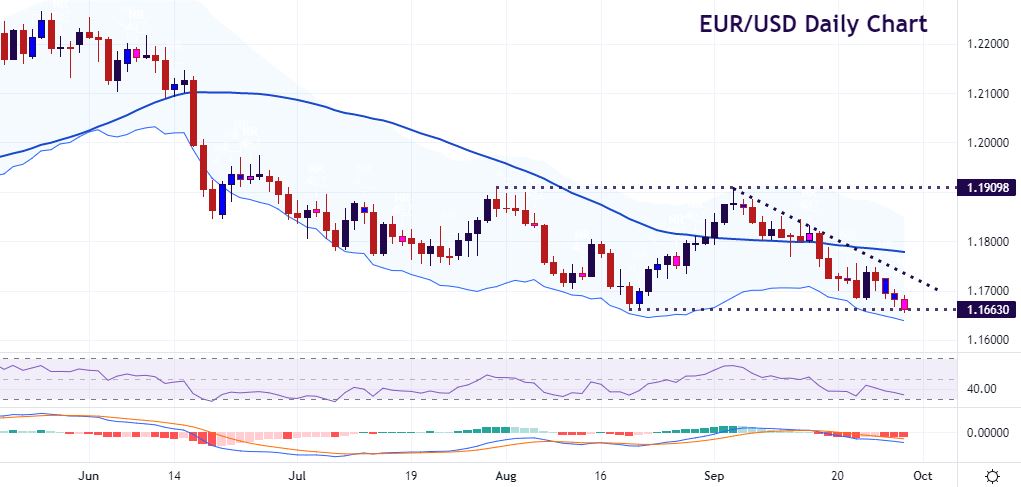

EUR/USD going lower on a weak close

Technically, this month’s downside pressure in EUR/USD from 1.19 has continued after being held up around 1.17. We made a new low this morning at 1.1656 which is its lowest since November 2020. The previous year-to-date bottom came in last month at 1.1663.

Confirmation of the downside break by way of a daily close is really needed to see prices go lower. But beyond the August trough, the world’s most popular currency pair sees limited support until the floor at 1.16 followed by 1.15. Bearish momentum seen over the last few weeks remains, though big levels can take time to be decisively broken.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.