March 10, 2022 9:04:57

The huge risk-on move seen yesterday in markets looks fragile. Big rebounds are inevitable during times of high uncertainty and volatility. And previous rallies like the one seen yesterday in stock markets typically haven’t signalled a turning point in the crisis. There seems to be a lot of hope around the meeting of Russian and Ukrainian foreign ministers today. The ECB meeting this afternoon is expected to be one of caution until the fog of war clears.

The bank is caught between a rock (geopolitics) and a hard place (inflation). This current trade-off puts President Lagarde in a tough spot. Already high inflation is under severe upward pressure, and this will have to be addressed. But the situation is highly uncertain with growth subdued. So, policy normalisation is expected to be postponed until there is more clarity.

Several ECB watchers are still sticking to the ending of QE later this year, followed by a rate hike in the final quarter. In light of recent market chatter about a much more cautious tone, that would be a more hawkish surprise and lend some support to the battered euro.

Market reaction will be clouded by the release of US CPI data at the same time as President Lagarde starts reading her statement. Consensus sees a headline of 7.9% and the core rising to 6.4%. It seems that the latter will need to print well above 8%+ for the markets to reconsider a 50bps rate hike by the Fed next week.

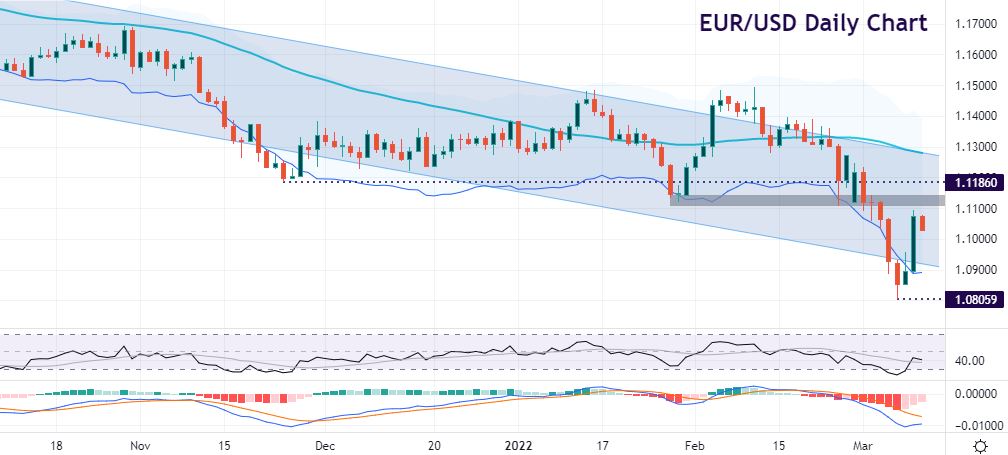

EUR/USD rebound relieves oversold conditions

The euro remains the bellwether for risk sentiment and trend in commodity markets. The huge bounce over the last two sessions came after a new cycle low at 1.0805. But the pair was severely oversold with prices spiking down through the lower Keltner band and daily RSI below 23.

Prices are now also back in the long-term descending channel from the May 2021 highs. They dipped out of this in November before tracking sideways during December. Buyers initially need to clear a resistance zone around 1.11. Above here sits the November low at 1.1186.

But the longer-term technical picture remains bearish. Support is 1.10 and 1.0958 ahead of big figures below. Much depends on the geopolitical situation, ahead of a historic ECB meeting amid a conflict on its borders.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.