May 14, 2021 14:22:05

The single currency sits in the middle of the majors on month-to-date performance but a strong close today could see more buyers enter the fray. Germany is really ramping up its vaccine rollout while the number of infections continues to decline with hope for an opening up of the economy in due course. The data calendar has been quite sparse recently, but focus will turn to next week’s PMI figures released on Friday.

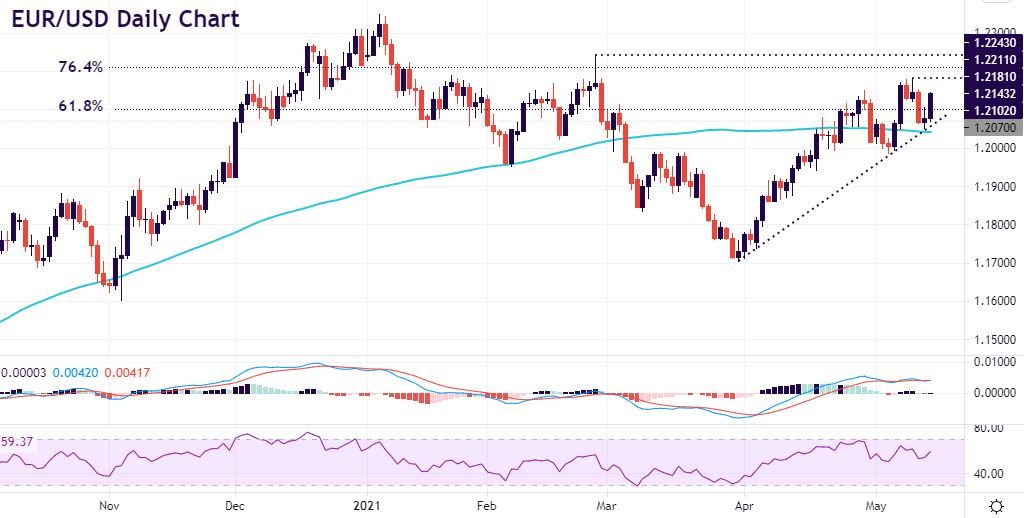

EUR/USD trendline support doing a job

EUR/USD bounced off its 100-day SMA and trendline support yesterday as stocks and risk in general made its comeback and the dollar was sold. Buyers also took the pair through a Fib level just above 1.21. If the pair can close above last week’s high at 1.2171 then the bulls are back in charge and the world’s most traded pair can continue its uptrend from the March lows. Support lies at 1.21 while targets above are the next Fib level at 1.2211 and the February high at 1.2243.

The trend is your friend in EUR/JPY

EUR/JPY has been priting a wonderful series of higher highs and higher lows in a near perfect bullish channel since November last year when the positive vaccine news came out. We highlighted a few weeks ago how multiple timeframe momentum indicators (DMIs) were all aligned bullishly so any consolidation after breaking to new highs at the end of April should have been brief. And so they were as we’ve carried on making new highs to levels not seen since the Autumn of 2018. The RSI is mildly overbought touching 70 but for sure, any pullbacks are an opportunity to get long in this bullish trend. Stops could be placed at this week’s low at 131.64 while initial upside targets come at the September 2018 highs around 133.12 and 133.48 which is the April 2018 top.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.