July 9, 2021 11:34:46

EUR/CHF plunges on risk off mood

EUR/CHF suffered its biggest sell-off in over three years yesterday as CHF’s safe haven status saw it vie with the yen as the leading major on the month.

The pair has broken through long-term trendline support from the May 2020 lows and the 200-day SMA. These levels now act a resistance zone around 1.0870 up to near 1.09. We are currently sat on the bottom of the bear channel that has been in play since this year’s high and a key Fib support at 1.0844 (61.8% of 1.0654/1.1151 advance). The daily RSI also touched oversold levels.

This means we should expect some consolidation and a retrace after such an explosive move up to the June lows at 1.0870 and potentially the resistance area. Stops can be placed below yesterday’s lows at 1.0824 with bears hopeful of pushing lower below 1.08 if the sour risk sentiment continues.

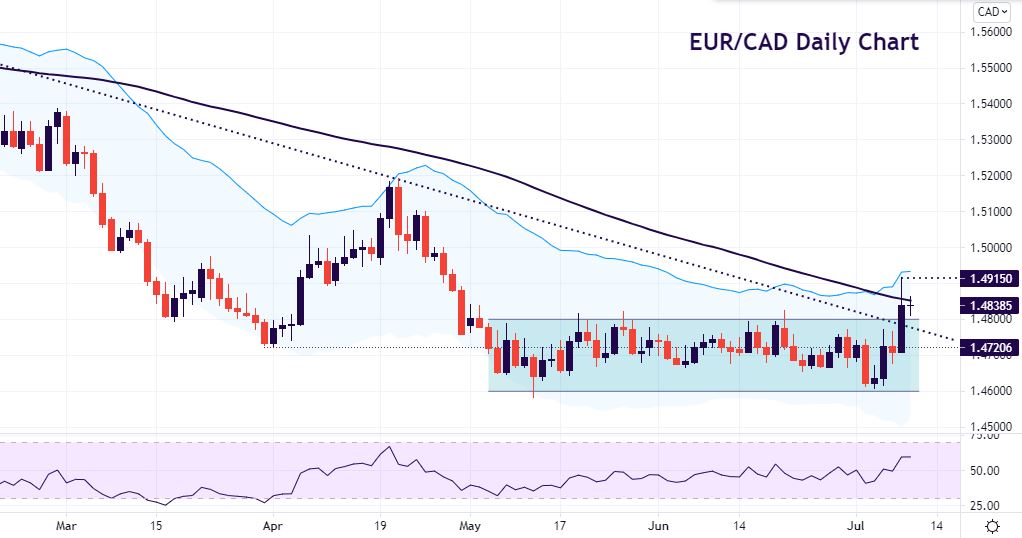

EUR/CAD pushes out of range

This euro cross had been trading sideways for several weeks between 1.46 and 1.48 before yesterday’s sharp move up to a high of 1.4915. This bullish move broke the resistance trendline from the December highs but pulled back into the close, below the 100-day SMA. With the upper Keltner band not fully pierced, we may see a decent pullback over the next few sessions with a move down into the previous range pointing to a failed upside break.

Solid Canadian jobs data this afternoon could help underpin loonie strength in the near term, with any disappointment potentially validating the move higher.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.