February 25, 2022 8:58:36

Russia’s offensive in Ukraine continues into a second day and has seen a classic investor demand for safe haven currencies. The yen and dollar have been bid, even though we have seen some fading of yesterday’s gains. The about-turn on Wall Street and the huge recovery in stock markets was driven by the new sanctions, or lack of them on Russian energy exports. Divisions about their exclusion from the international payments system (SWIFT) have also been key and may be crucial going forward.

But the yen should remain in demand as uncertainty remains high. The immediate fallout from Western sanctions will take some time to trickle through the system. They may also still take on another dimension depending on the next steps by the Kremlin.

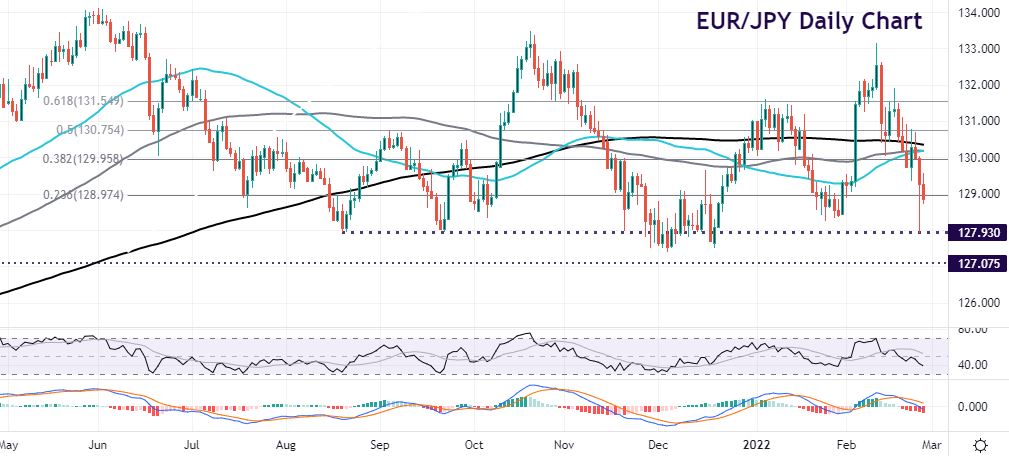

EUR/JPY rebounds back into the range

This pair has been trading in a pretty random fashion over the past several months. Buyers have struggled to maintain gains above 133. The recent spike higher to 133.15 two weeks ago was especially short lived. Price have declined since, only momentarily pausing around the 50, 100 and 200-day SMAs above 130.

These oscillators are all now converging together as the cross struggles for long-term direction. Yesterday’s sharp selloff saw prices push below the next Fib level (23.6%) of the June to December 2021 price move at 128.97.

The low of 127.91 breached the August support but buyers quickly took the pair back to the Fib level. That means the 128 area is now very strong support, with the December lows from last year also helping. Resistance above sits at 129.95 and the SMAs around 130.17/23/34. Another sharp selloff could see the September 2020 high at 127.07, but only if the 128 is broken decisively.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.