June 7, 2021 13:58:18

While there is some concern over a possible postponement of the UK’s scheduled June 21 full reopening day, the market doesn’t appear to be that fussed with sterling pretty flat versus the euro today. Politicians are giving themselves as much time as possible to make a decision whereas economists reckon the economic impact won’t be significant if it is delayed a few weeks.

More important going forward may be central bank divergence with the BoE happy to see the UK recovery picking up, with the first interest rate rise possibly as early as the second half of next year. In contrast, the ECB is widely expected to play down even any trimming of their emergency QE program this week, copying the “go-slow” gear of the Fed.

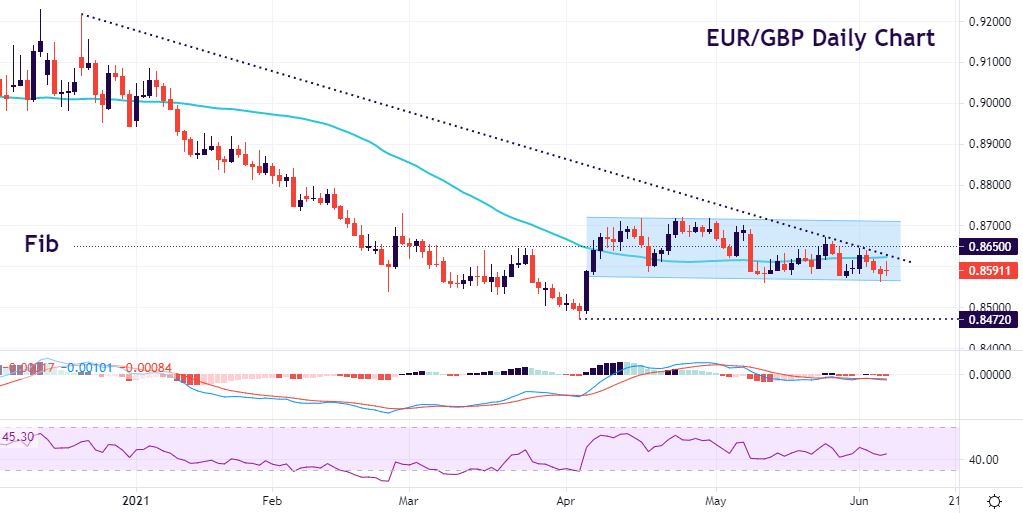

EUR/GBP has been in a long-term downtrend since December of last year when it topped out at 0.9230. Prices then fell in a bear channel printing a cycle low at 0.8472 before bouncing to just above 0.87. Over the last eight weeks, we’ve been trapped in a range trading around the 50-day SMA and a Fib level from the high/low over the last six months. Prices over the last week or so have been capped by the downward trendline from the late December high. Support again sits at the bottom of the recent range around 0.8560/65, so can the long-term bearish momentum prevail and break the botom of this range? If so, prices will head quickly to the cycle low at 0.8472.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, the United States, any other restricted jurisdictions (e.g. blacklisted FATF countries) or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets Ltd, authorised and regulated by the Financial Services Authority of Seychelles with License No. SD144. Moneta Markets Ltd is registered and located at Room B11, 1st Floor, Providence Complex, Providence, Mahe, Seychelles which operates under www.monetamarkets.sc.

You should consider whether you’re part of our target market by reviewing our , and read our other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.