January 3, 2022 15:42:45

Sterling enjoyed the holiday period as it rivalled the aussie as the leading G10 currency. There was some relief in the UK that the new Omicron variant won’t lead to severe restrictions, even allowing for record infections.

After the surprise rate rise by the BoE, money market traders have also piled on bets of more increases over the next year. The early start to the rate hike cycle will see rates climb to 1.25% with four 25bp increases expected, spread broadly across this year. This should keep GBP supported over the next few months.

Although this pricing seems aggressive, it stands in contrast to the ECB who are set to stick largely with their dovish policy settings. Continued weakening in the single currency is forecast by many with the region also appearing more likely to keep social restrictions in place for a longer period.

EUR/GBP teasing with new lows again

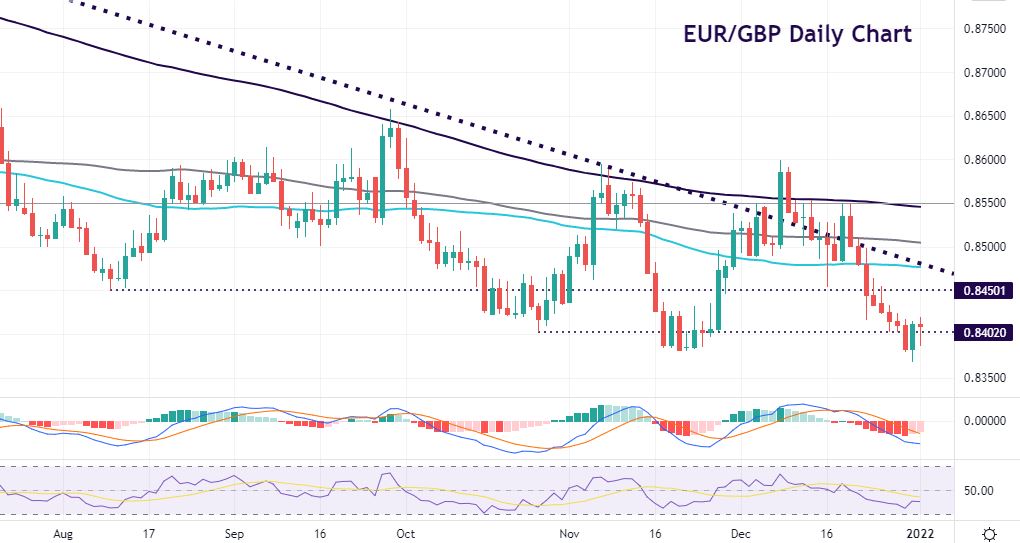

We wrote in the middle of last month about the prospect of how even an on hold BoE and dovish ECB would push this pair lower. Resistance was indeed seen at the midway point of this year’s high/low at 0.8549. More significantly, the 200-day SMA at 0.8550 plus trendline resistance from the December high capped any major upside.

Prices fell for eight straight sessions below the 50-day and 100-day SMAs. A new low was made at 0.8367 on the last day of December, a level not seen since February 2020. The pair has bounced from here but is struggling with the October low at 0.8402, even as bearish momentum has eased.

A weak close and sustained move below this level is needed to convince bears to add to their positions. The long-term downtrend does point to an eventual push towards 0.8275. Initial resistance above 0.84 sits at 0.8450.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.