EUR/CHF into 1.07 support zone

We’ve written before about the SNB potential “line in the sand” for EUR/CHF at 1.07 and we are hovering just above it at present. This appears to be the level where the central bank has intervened before to stop the swissie appreciating according to liquidity data and deposits. That said, if the bank was using the real trade-weighted CHF, the level would be lower.

We can see the pair bounced a couple of times in August from around this mark after dipping out of the descending channel from the March highs. The rebound took us above the 200-day SMA and briefly out of the bearish channel. Sellers have regained control again after consolidation around 1.0832. We are now close to the summer low at 1.0695.

Bearish momentum is still evident with prices not yet in oversold territory. The November 2020 low at 1.0660 is the next level of support if we continue to move in line with the dominant long-term trend. Another rebound, perhaps on the back of SNB intervention, will need to get back above 1.08 and last week’s high to slow the momentum.

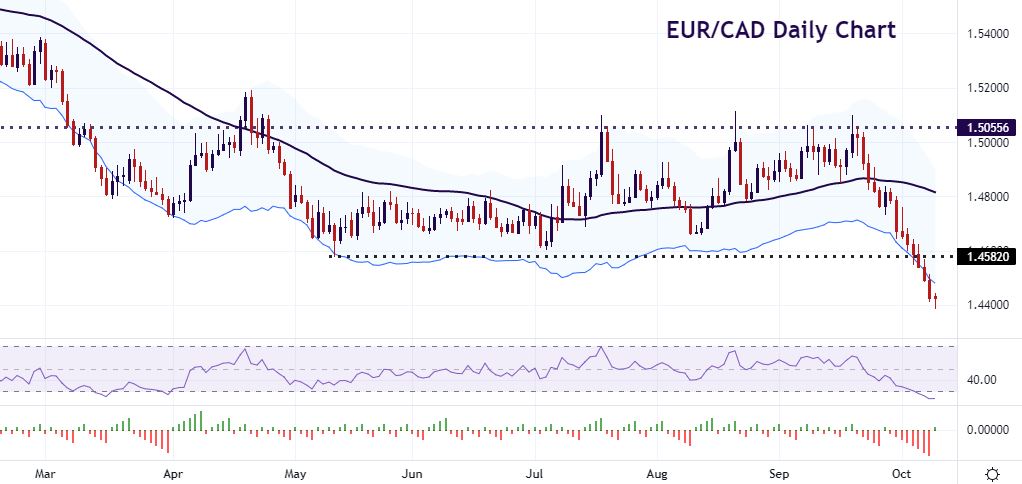

EUR/CAD sinks ever lower

This pair has dropped for nine straight days and counting, a run not seen since February last year. Notably, prices are now even more oversold on several momentum indicators, including the daily RSI. We are also through the lower Keltner channel so would expect to see some retracement.

Prices had been trapped in a range for several months between 1.46 and 1.50 more or less. But after topping out again last month around last summer’s lows, we’ve been in freefall, down 14 days out of the last 15. Initial resistance sits around the bottom of the recent range at 1.46. We are currently trading near the January 2020 lows and the October 2019 lows. The long-term low is the February 2020 spike low at 1.4263.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, the United States, any other restricted jurisdictions (e.g. blacklisted FATF countries) or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets Ltd, authorised and regulated by the Financial Services Authority of Seychelles with License No. SD144. Moneta Markets Ltd is registered and located at Room B11, 1st Floor, Providence Complex, Providence, Mahe, Seychelles which operates under www.monetamarkets.sc.

You should consider whether you’re part of our target market by reviewing our , and read our other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.