November 10, 2020 5:45:19

Market Update – 10th November 2020

The global stock market surged overnight as positive vaccine news emerged. Pfizer and BioNTech confirmed their experimental vaccines are more than 90% effective in preventing Covid-19 based on initial data from a large study. Earlier this week the Morrison government announced Australia had secured 50 million potential corona-virus vaccine doses through Novavax and Pfizer & BioNTech SE. The ASX has sored along with the UK and EU markets who have been hit for 6 since the second Covid-19 lockdowns. The SP500 has hit an all-time high tagging a key trendline resistance.

Tech stocks pulled back from their recent swing highs not liking the possibility of a vaccine. Tech stocks have provided a “safe haven” for investors throughout the Covid-19 pandemic. There is also the possibility of the Democrats breaking up “Big Tech” if they take the Senate over the coming weeks. We will see how this story develops over time.

Despite the media attempting to ignore Trumps latest comments, he remains a risk to the current market conditions. Trump fired Defense Secretary Mark Esper. Trump was active on Twitter throughout Monday’s session and announced Esper’s departure. This move could be seen as an aggressive play as Esper leaned against sending the military in to deal with the previous BLM protest and rioting. Trump is currently pursuing legal action against the Pennsylvania ballot, claiming more than 21,000 votes had been cast in the name of the deceased. There is little to report on this front so far. Interestingly, Mike Pence has remained silent since the election day.

We have seen pull backs across risk assets throughout the early Asian session. However, the recent vaccine news may give investors and risk on traders something to cheer about in the days to come.

EURUSD Daily Charts

The daily charts are showing a new base around the 1.1600 handle. The market has printed a higher high with a very strong impulsive move over the past couple of trading days. However, the shorter-term time frame is suggesting a pullback is on the cards.

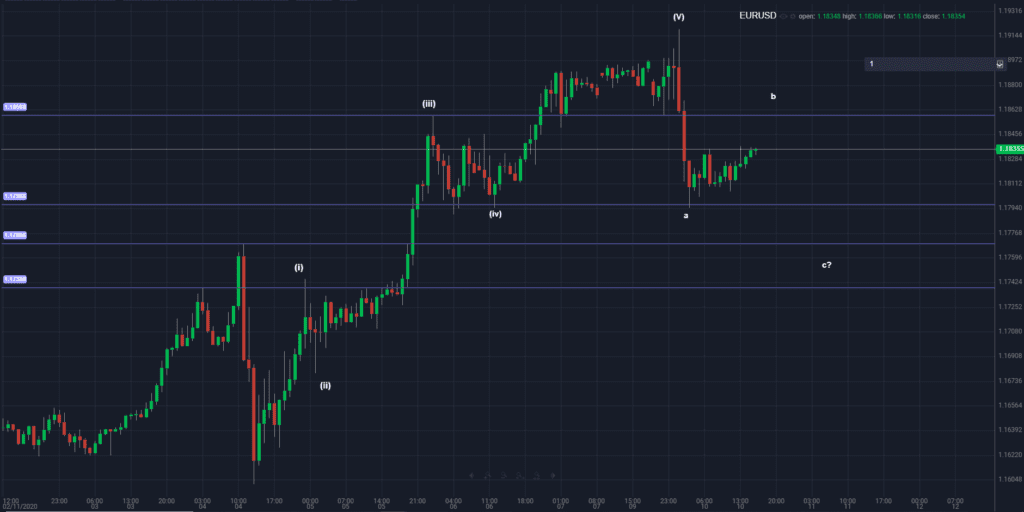

EURUSD 1 Hour Charts

Taking a look at the shorter-term time frame we can see a five wave structure higher. Based on Elliott wave theory, we could expect to see an A-B-C correction before continuing the bullish trend. There is also a possible head and shoulders formation setting up, with the shoulder line sitting at roughly 1.1840. A rejection from this level could indicate a move below the neckline towards support at 1.1750.

Overall the trend remains bullish, however, in the shorter-term, there is a potential deeper correction on the cards.

Let us know your thoughts below.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.