November 2, 2021 15:45:15

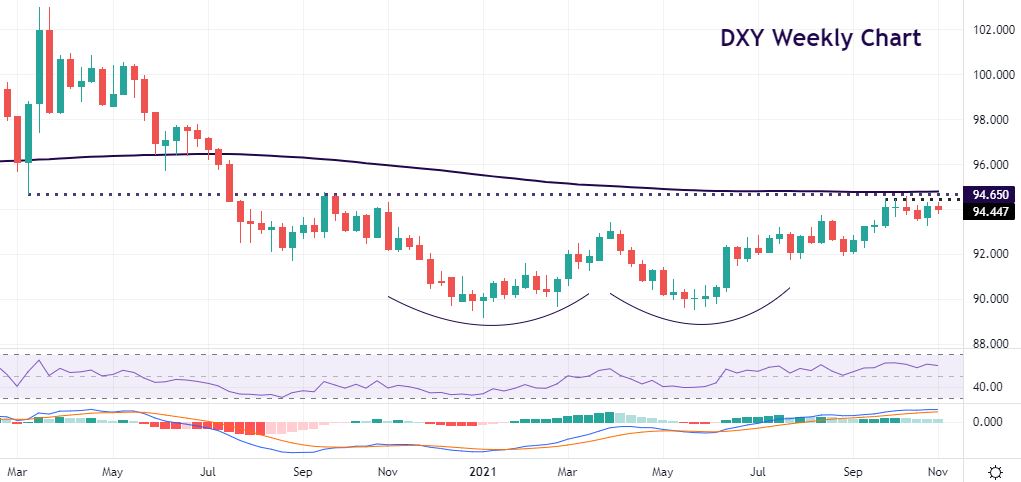

Weekly DXY: Consolidation above multiple levels of resistance

We can see on the weekly chart, the widely watched Dollar Index (DXY) looks to have formed a double bottom reversal pattern around 90 during January and May earlier this year. The measured move, which is the distance from the reaction extreme to the next price target, comes in roughly around 94.90 Since May, prices have been edging higher. But after five weeks of gains from September, bulls came up against resistance around 94.50.

We have been consolidating below here as this level marks a major zone of resistance. This area includes the October high at 94.56 and the March 2020 spike low at 94.65. The 200-week moving average also sits just above here at 94.79.

Last week’s bullish engulfing pattern looks positive for the greenback’s overall performance outlook. But much depends on the Fed and Friday’s NFP data. Initial support around 93.27/50 needs watching if the policymakers or job numbers disappoint again.

Daily DXY: Bounces off trendline support

We can clearly see the ascending channel of higher highs and higher lows from the May/June trough on the daily chart. Prices have been well supported by both the 50-day SMA and the upward trendline from May.

After topping out in September and October above 94.50, we are back trading just below 94. Momentum is fairly subdued at the moment which you would expect with traders neutral ahead of the upcoming risk events.

If oscillators turn more bullish, then a decisive break to the upside through the zone targets the June 2020 low at 95.71. The 50-day SMA and trendline support come in around 94.37/40.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.