September 29, 2020 0:38:21

Market Wrap – 29th September 2020

Global equities surged higher throughout Monday’s trading session and the USD retreated from its nine-week high. The safe-haven demand of the USD dimmed somewhat as traders cheered fresh reports from Nanci Pelosi suggesting a second stimulus package was still on the cards. Traders are expecting fireworks this week as the economic calendar heats up, GDP, US unemployment and Non-Farm payrolls are scattered throughout the week. However, first, the world will be watching the Trump and Biden presidential debate on Tuesday.

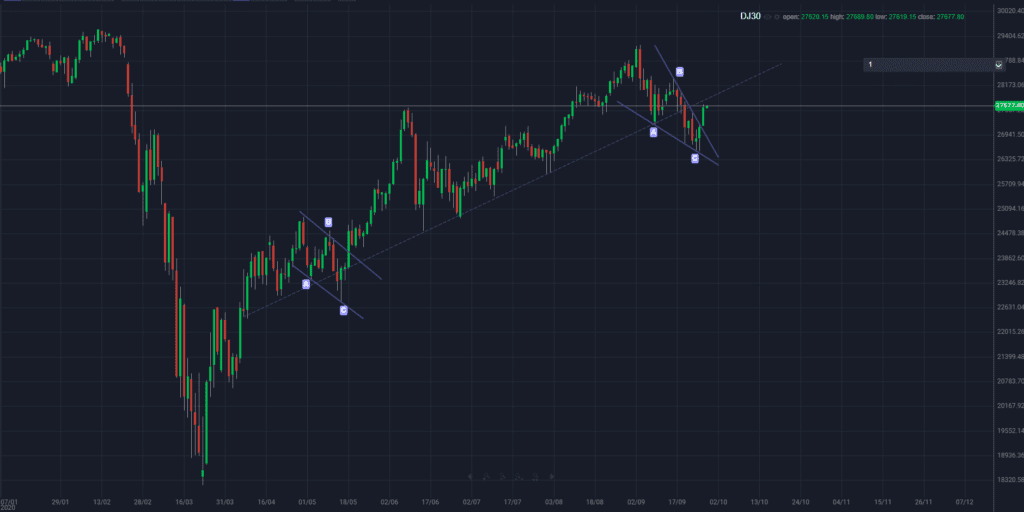

The US stock market could be heading for another leg higher after completing an A-B-C corrective structure. The Dow Jones has exploded out of a falling wedge formation and is currently testing a key trend line.

DOW JONES – Technical Analysis

Bears will need to defend the 27,900 trend line hurdle. A break above the trend line could open the doors for the next bull run. However, with numerous high impact risk events this week the market could be presenting the calm before the storm. First up we see Donald Trump take on Joe Biden in the presidential debate on Tuesday. The public will likely want to hear about the recently leaked documents regarding Trump’s tax affairs. This may not move the financial markets but will at least provide a comical viewing.

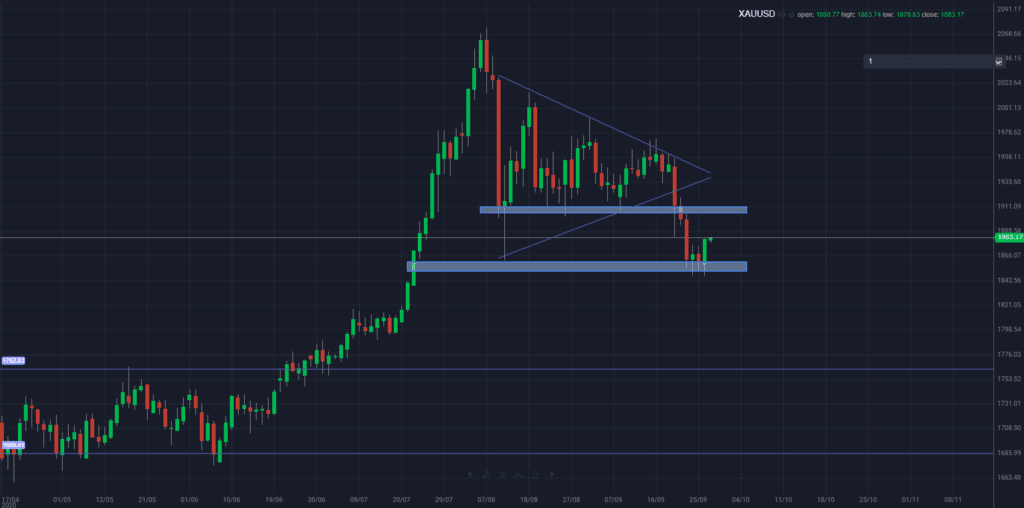

GOLD

Commodities are benefiting from a weaker greenback with gold finding strong support at the 1855 level. Gold may retest the broken support, now resistance level at 1910. One question traders are currently asking is, is the GOLD bull run over?

Whilst this question remains unanswered, we may get an indication this week. Golds bull run has been dented by the recent rally in the USD. Short term we may see gold retest the 1910 handle whilst it consolidates and waits for a fresh direction. Bulls will need to see a series of higher highs and higher lows before considering an additional move higher.

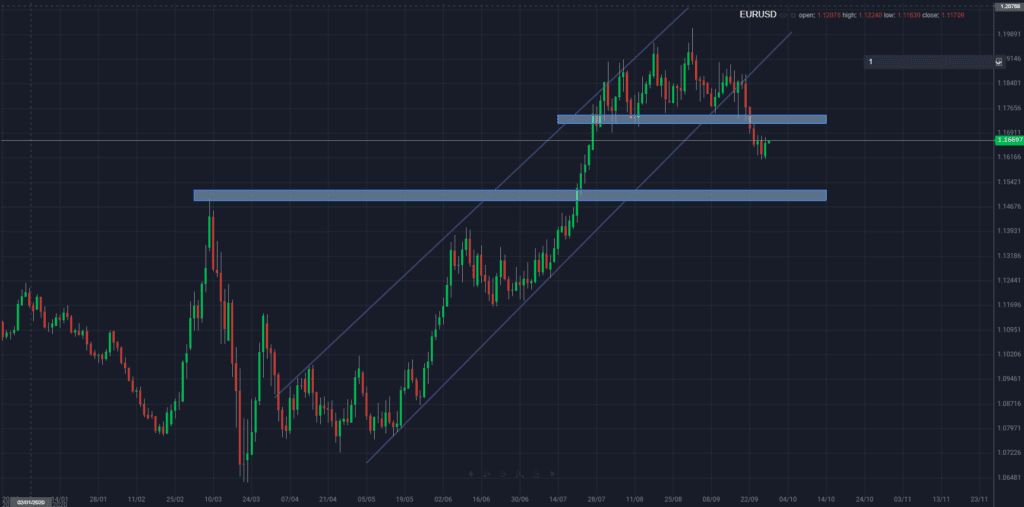

BREXIT

The UK press has reported a Brexit deal is potentially still on the table suggesting the EU is willing to work on writing a joint trade agreement with the UK. This comes after the GBP and EUR suffered a huge amount of selling pressure due to the Internal Market Bill put forward by Boris Johnson and the stronger USD. The turn of events could provide much-needed support to the GBP and the EUR.

The EURUSD has taken out the inclining channel after completing the head and shoulders formation. Short term we could see the EURUSD retest the broken support zone acting now as resistance at 1.1720. This week will be crucial in providing stimulus and direction for the next move on the EURUSD. A stronger USD will give bears the chance to tackle the 1.1500 support level.

We are setting up for a very exciting trading week. Markets may remain relaxed until fresh liquidity comes on board during the later stages on the Tuesday trading session.

If you have any questions on the topics raised above please reach out via email below.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.