Asian equity markets are mixed, reportedly due in part to disappointing after-hours results from some major tech companies. That is despite a broadly solid performance in European and US stocks. Yesterday, the Bank of England (BoE) and the European Central Bank (ECB) both raised interest rates by 50bp as expected. The BoE indicated that the outlook for further policy tightening was likely to be more circumspect. The ECB, meanwhile, telegraphed another 50bp in March but acknowledged that inflation risks have become ‘more balanced’ (less upside risk).

This morning’s UK and Eurozone services PMI reports for January are final readings and are expected to be unrevised from the preliminary ‘flash’ releases, although there will be new information on Italy and Spain. UK services PMI fell to 48.0 from 49.9 in December, according to the flash estimate, suggesting the downturn in activity deepened in the new year. In contrast, the Eurozone services PMI at 50.7 moved back into expansion territory for the first time in six months. Eurozone producer prices are also due and are expected to show a further moderation in the y/y rate.

BoE Chief Economist Huw Pill, who voted with the majority of the MPC yesterday for a 50bp rise in interest rates, is scheduled to speak today at around 12:15GMT. In comments earlier this morning, he said he was confident yesterday’s rate rise was necessary and appropriate.

The spotlight today is the US monthly labour market report for January. Despite anecdotal reports of job losses in the tech and other sectors, indications from the weekly initial jobless claims data suggest the broader labour market is not yet rolling over. We expect today’s report to show moderating but still solid activity, with nonfarm payrolls forecast to rise by 200k and the unemployment rate unchanged at 3.5%. The average hourly earnings data will be keenly watched after December’s downside surprise which raised hopes of a ‘goldilocks’ or soft-landing outcome. Earlier this week, the separate employment cost index showed further signs of moderation in wage growth in Q4. We expect today’s earnings growth to slow to 4.4% (year on year).

The US ISM services survey will also draw attention, especially after the surprisingly strong drop in December to 49.2. It is expected to stage a partial rebound to 50.5 which would signal a modest expansion of activity in the new year.

UK 10-year gilt yields fell to just above 3% yesterday, the lowest this year, following the BoE policy announcement. Markets are fully pricing in only one more BoE 25bp hike. In currency markets, the pound has dipped below $1.22 this morning, while the euro also weakened towards $1.09 after the ECB policy update, although it continued to outperform sterling.

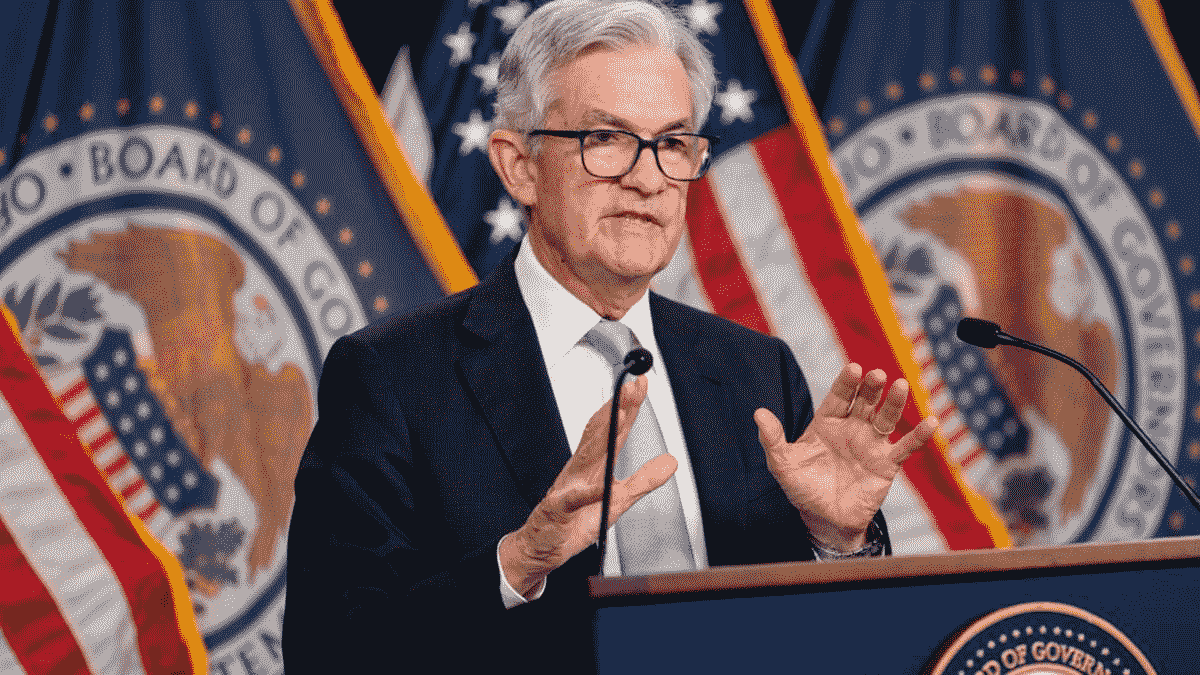

US equity and Treasury markets rallied following the Fed policy update yesterday. Asian stocks overnight are also mostly higher. The Fed hiked again but the 25bp increase (to 4.75% as expected) was the smallest since last March. Although Chair Powell signalled further rate rises and pushed back against market expectations for rate cuts later this year, there was acknowledgement that inflation has ‘eased somewhat’. He indicated that there would probably be ‘a couple’ more rate hikes. Overall, it appears that the Fed was less hawkish than markets had feared.

Following on from the Fed yesterday, the Bank of England (BoE) and the European Central Bank (ECB) will both provide policy updates today. Both central banks are expected to raise interest rates again. The BoE announcement is at midday and the press conference with Governor Bailey kicks off at 12:30GMT. The ECB announcement is at 13:15GMT and the press conference with President Lagarde begins at 13:45GMT.

For the ECB, another 50bp hike has been telegraphed by policymakers, which would raise the deposit facility rate to 2.5%. The Eurozone economy avoided contraction in Q4 and, while inflation has started to fall, rate-setters remain concerned that core inflation is trending higher. With today’s decision fully discounted, markets will be looking for clues that another 50bp hike is on the cards for the next meeting in March, as favoured by more hawkish members of the ECB Governing Council.

There is a bit more uncertainty for the BoE decision, but markets are pricing in a high probability of another 50bp rise to 4%. While a couple of MPC members will probably continue to vote against a rate rise, the majority will point to upside inflation risks including from wages and services prices. Aggregate inflation is set to fall this year, but stickier services inflation provides the justification for a further hike today. Economic growth forecasts could also be revised higher. Markets will be watching closely for indications on whether the door for interest rates to rise above 4% is left open. Governor Bailey recently indicated that market expectations for around a 4.5% peak in rates were not ‘out of line’.

In the US, durable goods orders and weekly jobless claims data are due. Ahead of tomorrow’s monthly jobs report, initial jobless claims are expected to edge higher from the prior week but to remain historically low, reaffirming that the labour market remains tight.

Following yesterday’s Fed decision and ahead of the BoE and ECB updates, GBP/USD and EUR/USD have risen towards 1.24 and above 1.10, respectively. That means the pound is also trading at bottom of the recent range against the euro. US 10-year Treasury yields were broadly steady during Asian trading, having fallen to around 3.40% post-Fed.

Asian equity markets are mostly up this morning. That follows a sizeable rise in US equities fuelled by weaker than expected US wage data, which boosted hopes of a more dovish tilt in monetary policy at today’s Federal Reserve policy update. In China, the unofficial Caixin manufacturing PMI rose in January but stayed below the key 50 level signalling contraction. The UK faces its biggest day of strike action of the winter so far with many schools set to close in addition to severe disruption to rail services and to other parts of the public sector.

The US Fed Reserve is expected to raise interest rates again tonight with its eighth successive hike. However, markets also expect a second successive slowdown in the pace of increases, with rates this time going up by 25 basis point (to a new upper band of 4.75%) as opposed to 50bp in December and 75bp at the four previous meetings.

If there is a surprise in tonight’s update it will most likely be in the guidance on further actions. This is not one of the meetings where forecasts, including the ‘dot plot’ of interest rate projections are updated. So any new information will come from the press statement and from Fed Chair Powell’s press conference. With inflation now slowing Fed policymakers may be thinking about calling a halt to rate hikes. But they will be wary of adding to the already bullish mood of markets. So for now, Powell may still emphasise concerns about inflation and to reiterate caution about market expectations that rates will be cut this year.

The January Eurozone CPI report is expected to show a second consecutive fall in headline inflation. The postponement of yesterday’s German release means there are less data clues than usual at this stage. However, rises in inflation in France and Spain suggest that the fall in the region as a whole may be modest. We look for a decline to 9.0% from 9.2% in December with the core rate down more modestly to 5.1% from 5.2%. That is unlikely to be enough of a slowdown to have any impact on this week’s European Central Bank’s policy deliberations.

January manufacturing PMI data for the UK and the Eurozone are mostly second readings. The first set of updates showed both headline indices up from their December levels but still well below the 50-expansion level.

For the US, the January ISM manufacturing index will be new. In December it fell again and was below 50 for the third month in a row. Reports of continued weak orders suggest that the January reading will also be below 50.

US bond yields fell sharply yesterday after weaker than expected US labour cost data, while UK bond yields saw more modest declines. In currency markets, the US dollar came under some downward pressure versus the euro and sterling as markets anticipated a more dovish Fed message. The market moves, however, were relatively modest.

Asian equity markets are mostly down this morning as nervousness grows ahead of key monetary policy updates in the US, UK, and Eurozone. In China, better than expected PMI data for January supported expectations that a loosening of Covid restrictions is lifting economic growth. In particular, the non-manufacturing index rose to its highest level since last June. In just released economic forecast updates, the IMF upgraded its 2023 global growth forecast but cut its estimate for the UK. It expects the UK to be the only major economy to see a fall in output this year and predicts only a moderate improvement in 2024.

Data on UK money supply and personal lending will provide further insight on housing market activity. Mortgage applications have slipped sharply in recent months and in November were at their lowest level since just after the first 2020 lockdown. We expect the December data to show another sharp drop. Also of interest will be December consumer credit as the recent rise in this series potentially indicates that some households are increasingly relying on borrowing to tied them through the cost-of-living crisis.

Yesterday’s Q4 German GDP data, which posted an expected fall of 0.2%, has raised the odds that output in the Eurozone as a whole also declined. The drop was partially by a rise of 0.1% in French GDP. Nevertheless, we have revised down our forecast for Eurozone GDP to show a 0.1% fall compared with a previous estimate of unchanged activity.

Meanwhile, today’s German CPI release for January has been postponed. Following a higher-than-expected outturn for Spanish CPI inflation today’s German figures were expected to further shape expectations for tomorrow’s Eurozone numbers. Those seem set to show a fall in headline inflation but remain sufficiently high that they will do little to alleviate European Central Bank concerns about inflation risks.

The US employment costs index, which Federal Reserve policymakers regard as one of the most reliable indicators of labour market cost pressures, will provide invaluable information on domestic inflationary pressures ahead of tomorrow’s US monetary policy announcement. We expect it to show a rise of 1.2% – the same as Q3. The Fed would probably regard that as too high to be consistent with meeting its inflation target. Even a much lower number is unlikely to prevent the Fed from raising interest rates tomorrow, but it may further boost market hopes that rates are very close to a peak.

Bond yields rose yesterday in both the UK and the US reflecting uncertainty over how much support this week’s policy updates will give to hopes that interest rates are close to a peak. In currency markets. the more ‘risk-off’ investor environment helped the US dollar edge up against sterling and the euro.

Stock markets across the Asia-Pacific region are mostly trading lower this morning ahead of looming policy decisions from a number of major central banks. Nevertheless, overall market risk sentiment has been broadly constructive since the start of the year, supported by evidence that inflation is on the way down and optimism that some of the downside risks to global growth prospects have subsided.

The business barometer survey for January was released overnight. It showed overall business confidence started the New Year on a positive note, rising for a second month in a row. Headline business confidence rose by 5 points to 22%, its first back-to-back increase since September 2021, taking it to the highest level for six months. It has made significant headway towards the long-term average of 28%. The upturn was again driven by a more optimistic assessment of the wider economy which has posted sizeable gains since November’s nadir. Firms’ own trading prospects were unchanged on the month but continued to outperform economic optimism, suggesting some resilience in the outlook for business activity in the face of economic headwinds. Year-ahead anticipated staffing levels edged higher, but the broad trend is still lower since the summer. Businesses’ pay growth and own pricing expectations eased but remain near highs. The latter fell for the first time in five months.

Ahead of a triptych of monetary policy updates from the US Federal Reserve, the European Central Bank (ECB) and the Bank of England (BoE) later in the week, today’s economic data slate is unlikely to garner much market attention. Ahead of tomorrow’s preliminary estimate of Q4 Eurozone GDP, today’s reading from Germany should attract some attention. Recent indicators suggest the Eurozone economy held up better than expected late last year and may have skirted a contraction in Q4. Germany is forecast to have registered flat growth in Q4, however, a stronger outturn would fuel expectations of a better outturn for the Eurozone as a whole. Spain will release preliminary CPI figures for January, with forecasts centred on a further softening in the annual rate – from 5.5% in December to 4.8% in January – supporting expectations that aggregate Eurozone inflation all softened further this month. A number of Eurozone confidence measures for January are due with broad improvements.

Meanwhile, overnight, Japan will release December labour market, industrial production and retail sales data. Elsewhere, China PMIs for January will be interesting to assess the impact of the shift from a zero-Covid policy to economic reopening.

The US dollar has started the week slightly firmer in response to investor caution about this week’s policy updates. GBP/USD has edged back below 1.24, while EUR/USD has eased back to around 1.0850.

Asian equity markets remained in constructive mood following rises in US and European stocks. Yesterday’s US data were positive, at least on the surface, with Q4 GDP growth of 2.9% (q/q annualised) beating expectations. That, however, was slightly lower than 3.2% in Q3 and the relatively subdued pace of growth in consumer spending points to potentially softer GDP growth in 2023. In Japan, Tokyo CPI was stronger than expected with the core measure excluding fresh food rising to 4.3% in January from 3.9%, adding to speculation of Bank of Japan policy changes later this year.

There are no UK data releases today. Chancellor Jeremy Hunt is scheduled to deliver a speech on achieving growth in key sectors including digital technology, green industries and life sciences, as well as setting out a long-term plan to improve productivity. Markets will look ahead to next week’s monetary policy update from the Bank of England (and also the Federal Reserve and the European Central Bank).

Spain will release Q4 GDP this morning, the first country to do so in the single currency area. Eurozone M3 money supply and Italian industrial sales data are not likely to attract much attention. The Spanish economy is expected to have eked out growth of 0.1%q/q for a second quarter in a row. Next week, Q4 GDP estimates for Germany, France, Italy and the Eurozone will be released. Recent economic indicators suggest that a Q4 contraction in the Eurozone is less likely or likely to be shallower than had been previously expected.

In the US, the December PCE deflator – the Fed’s preferred inflation measure – will be released. It is expected to confirm the message already given by the CPI data that both headline and core inflation fell last month. We forecast the headline PCE deflator to fall to 5.0% from 5.5% and the core PCE deflator to decline to 4.4% from 4.7%. Personal spending, meanwhile, is forecast to have fallen. Such outturns would reaffirm that inflation is on the way down and economic growth is slowing, adding to expectations that US interest rates are close to peaking.

The final release of the University of Michigan’s US consumer sentiment survey for January will probably be unchanged from the preliminary reading of 64.6, up from 59.7 in December. The preliminary results also showed one-year-ahead inflation expectations falling to 4.0%, the lowest since April 2021.

Market reaction to yesterday’s US data was broadly risk positive, albeit volatile. US 10-year Treasury yields rose above 3.5%. GBP/USD is broadly unchanged below 1.24. The Japanese yen is a little firmer following the Tokyo inflation data.

Asian equity markets are mixed with the notable exception of Hong Kong’s strong rise as it plays catch-up following its return from the lunar new year break. US stocks had ended little changed, erasing losses through the day. The Bank of Canada yesterday raised interest rates by 25bp to 4.5%, as expected, and said it will pause after hiking by 425bp over the past year.

The CBI distributives trades survey will provide an early gauge of UK retail activity at the start of 2023. In December, the survey’s net balance for the volume of sales rose to 11, but the metric measuring sales for the time of year (which fell to -3) appears to have been a better indicator of the disappointing decline in official retail sales during the month. The GfK consumer confidence index in January fell unexpectedly to -45, reflecting ongoing heightened consumer caution, although it remained above September’s low of -49.

Today’s main market focus is the first estimate of US Q4 GDP. It is forecast to show a second successive quarter of growth after the decline in the first half of last year. The weakness in some December indicators suggests that growth may be lower than was initially expected but we still look for a solid rise of 2.2% (annualised quarter-on-quarter growth). Markets, however, may regard this as ‘old news’ and may instead focus on whether December negative surprises were primarily the result of the severe storm late in the month or a harbinger of further weakness in Q1. US durable goods orders will provide further clues on these and are expected to point to the likelihood of activity remaining subdued early in Q1, particularly in manufacturing.

Also out in the US today are weekly jobless claims data, new home sales and the Kansas City Fed manufacturing survey. The claims data have yet to signal a significant weakening of labour market activity, but housing activity has been slowing for a while in response to higher interest rates, although there have been some recent tentative signs of stabilisation. December new home sales are forecast to fall after November’s unexpected rise.

Elsewhere, in light of ongoing speculation of changes to Bank of Japan policy later this year, there may be some focus on Tokyo CPI data for January ahead of the national figures in a few weeks’ time. The Tokyo core CPI measure, which excludes fresh food, is forecast to rise to 4.2% from 3.9%.

The US dollar continued to soften on speculation that Fed interest rates are nearing a peak. That helped GBP/USD recoup losses associated with disappointing UK PMI survey data earlier in the week. The cross traded back up towards 1.24, although the pound remains weaker against the euro as EUR/USD rises above 1.09.

Many Asian equity markets continue to be closed for the lunar new year but those open have seen mixed performances. The latest inflation reports in Australia and New Zealand proved to be stronger than expected, boosting expectations of further interest rate rises in both. However, in the UK the latest producer price data for November and December showed a moderation in both input and output price inflation due to lower oil prices and the easing of some global bottlenecks.

The German IFO stands out in an otherwise sparse calendar. It will be watched for further confirmation of the recent signs that Eurozone economic conditions are stabilising after yesterday’s German and Eurozone PMI reports for January pointed in that direction. The composite PMI measures in both cases rose from their levels in December. For the Eurozone as a whole, the overall index measure moved above the 50 level that signals an expansion in economic activity for the first time since last June. For Germany, the combined manufacturing and services index stayed just below 50 but services moved above 50 for the first time since June, a sign that domestic conditions are improving.

That lends support to European Central Bank President Lagarde’s comment that there are signs that economic conditions had improved since the ECB last updated monetary policy in December. Recent IFO readings also point that way. The headline index rose in both November and December, primarily because of an improvement in expectations but also with some tentative signs that current conditions are improving. Today’s January update is expected to see a further rise in both components.

Markets are expecting the Bank of Canada to raise interest rates again today but this time are looking for only a 25 basis point hike. That would be the smallest increase since the BoC’s first move in this tightening cycle, which so far has seen rates raised by 400bp. There is also a lot of speculation that this may be the last hike for now amid growing concerns about downside risks for growth. Consequently, so there the updated Monetary Policy Report and BoC Governor Macklem’s press conference will be watched for signs whether that is likely to be the case.

The Bank of Japan will release a summary of opinions of policymakers from its January policy meeting this evening. The more detailed minutes of the December meeting, when the BoJ surprised markets by raising the ceiling for bond yields, suggested that that should not be interpreted as a monetary policy tightening move. Nevertheless, today’s note will likely be watched for clues on how close the BoJ is to a hawkish policy pivot.

Bond yields in both the UK and the US fell yesterday as the outcomes of next week’s interest rate updates were eagerly awaited. Meanwhile in currency markets the US dollar remained under pressure against both the euro and sterling as it slipped to a new low for the year against the former.

Several Asian equity markets are closed for the lunar new year holiday this morning but those that are open are mostly up on the day. The oil price is showing signs of levelling off after a rise over the past couple of weeks that has taken it to an early year high. The move seems to partly reflect hopes that China’s removal of Covid restrictions will boost demand.

Just released UK public finance data for December showed net borrowing at £26.6bn, which is more than double its level at the same point a year ago. However, the full year deficit may still undershoot forecasts. Next month’s figures which will include self-assessment tax revenues will be important in determining whether that could prove to be the case. Meanwhile, the fall in gas prices in early 2023 is boosting hopes that the cost of the energy price subsidy in the 2023/24 budget will be less than originally estimated.

The rest of today’s calendar is dominated by PMI updates. In the UK, both the manufacturing and services headline indices stayed below the key 50 level that signals a contraction in activity in December, although for services that was only marginal. For January, we expect small falls in both indices signalling a likely continued drop in manufacturing output and at best very modest growth in services. Also to be watched for closely are further signs data of an easing in inflationary pressure and supply chain bottlenecks. The CBI industrial survey will later provide an alternative reading on industrial trends.

The manufacturing and services PMIs for the Eurozone were both below 50 in December. However, the services index was only just so and we expect a rise in January to take it back above the key 50 level. That seems consistent with European Central Bank President Lagarde’s comments that the economic environment looks a touch less negative. In contrast the manufacturing reading is forecast to stay well into contractionary territory. Nevertheless, overall, the data is forecast to be consistent with the possibility that the Eurozone may still dodge a technical recession.

The US PMI indices are also expected to post another set of sub-50 readings. Typically, these tend to be less closely watched than the more established ISM surveys due next week. However, markets may see the data as further confirmation that US interest rates are close to a peak.

Bank of England and US Federal Reserve policymakers have already gone into silent periods ahead of next week’s policy update. The ECB’s Lagarde will speak today but she is unlikely to change expectations that Eurozone interest rates will be raised by another 50 basis points next week.

The US dollar remained under pressure yesterday particularly against a generally stronger euro. Sterling also fell against the euro as markets weighed up interest rate expectation ahead of next week’s monetary policy updates in the UK, US and the Eurozone.

A number of markets across the Asia Pacific are closed for the Lunar New Year holiday. However, those that are open are showing gains in equities buoyed by an overall positive market risk sentiment tone. Over the weekend, the Wall Street Journal reported that US Fed members were “preparing to slow interest rate increases for the second straight meeting”, building on similar comments that have been made by Fed officials of late. Equity futures point to positive gains on European exchanges at the open.

The more positive mood that has been seen in markets since the start of the year was again evident over the past week although market moves have generally been modest. Bond market yields have continued to slip on hopes that easing inflationary pressures mean that central banks will soon call a halt to the present cycle of interest rate hikes. Federal Reserve policymakers continue to express caution about an early peak in rates. A number have suggested that the pace at which rates are raised is likely to slow further to 25 basis points at the next policy update in early February (from 50 basis points in December). But they have also said that it is too early call a halt to tightening and certainly premature to expect a cut in rates. Possibly most significantly, markets are discounting earlier and more sizeable cuts in interest rates in the US than in the UK or the Eurozone.

With the early February monetary policy updates fast approaching Fed policymakers will go into their pre-announcement blackout from today. Bank of England officials will also go into their silent period from the second half of the week and no speeches from BoE rate-setters are scheduled ahead of then. That suggests we are not going to learn anything more about their respective policy intentions before their updates on 1st and 2nd February that will shift current market expectations of a 25bp rate hike in the US and a 50bp move in the UK.

Several speeches are expected from ECB policymakers this week including ones from Vujcic, Visco, Panetta, Holzmann and Lagarde today, but those seem unlikely to move expectations of another 50bp ECB rate rise on 2nd January. Today is short of major data releases with only the US leading index for December and the preliminary read of January Eurozone consumer confidence of note. The latter is expected to show a modest rise.

The positive market risk tone has continued to weigh on the US dollar, with the Bloomberg Dollar Index now down around 2% since the start of the year. GBP/USD has edged above 1.24 in early trading, while EUR/USD has moved up to around 1.09.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, the United States, any other restricted jurisdictions (e.g. blacklisted FATF countries) or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets Ltd, authorised and regulated by the Financial Services Authority of Seychelles with License No. SD144. Moneta Markets Ltd is registered and located at Room B11, 1st Floor, Providence Complex, Providence, Mahe, Seychelles which operates under www.monetamarkets.sc.

You should consider whether you’re part of our target market by reviewing our , and read our other legal documents to ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice if necessary.