July 5, 2021 14:03:31

Market expectations around the RBA meeting early tomorrow morning had shifted in recent weeks after several central banks turned more hawkish. Strong jobs data also helped validate these hopes with the economy recovering faster than the RBA expected.

However, with the return of lockdowns due to the Delta variant and wage growth still not materially higher than it was at the last meeting, the RBA’s recent tone has remained fairly neutral. Consensus expects little prospect of a change in forward guidance, but some tapering of bond purchases together with a message that there will be continued policy support. The aussie may sell off on any more cautious words, although the downside may be limited now that more hawkish expectations are less aggressive. Further out, if volatility stays low across the summer, other commodity currencies may be more in favour than AUD with carry trades in favour.

AUD/NZD stuck in sideways trade

AUD/NZD is looking for direction currently trading between some notable indicators and levels. The 200-day SMA sits at 1.0718 while two shorter-term SMAs are above at 1.0737. The long-term trendline from the March 2020 low is then above here around 1.08 as a target for buyers if the RBA takes on a Fed-like bullish shift, but this seems unlikely. Support below lies at the 50% retrace level of the December 2020/March 2021 high around 1.0683 with the next Fib at 1.0621. Momentum is lacklustre at present so in need of a RBA boost.

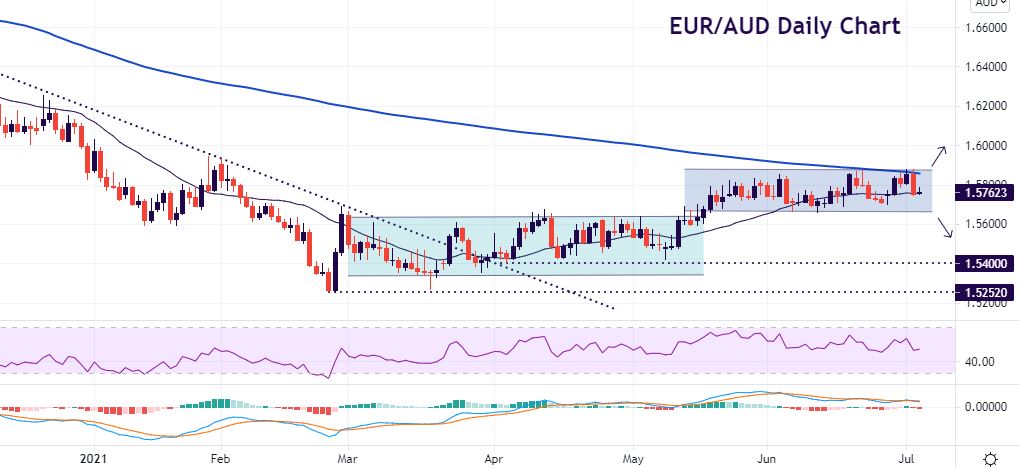

EUR/AUD middle of recent range

EUR/AUD looks to have found a base after dropping from October 2020 highs at 1.6827. A bottom around 1.5252/70 formed in February and March this year and we have traded in two broad ranges since, below 1.57 and more recently above this level. Prices have been supported by the 21-day SMA with June lows at 1.5659 next support. If the RBA is more dovish, the pair could push above the top of the recent range where the 200-day SMA resides around 1.5860/73.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.